The Best

Accounting Software

trusted by more than 270,000 companies

Recent Awards

Best Accounting Software

Best Customer Service

On Going Event

Bosses, and Accountants, did you know that even dividends are required to be e-invoiced?

In this seminar, you will not just be learning about the laws and regulations regarding E-Invoice. Our panel of experts will also share insider guides about LHDN E-Invoices, navigating dangers, exploiting opportunities. Are accountants and bookkeepers facing risks or riches?

- Pre-E-Invoice vs. E-Invoice: What’s changed and what needs your attention?

- Do’s and Don’ts: Navigate the transition smoothly and avoid pitfalls.

- Peppol vs. LHDN E-Invoice: Demystify the difference and understand compliance requirements.

- E-Invoicing Optional for Customers: What’s the Deal?

- Foreign Workers Without Permits: Self-Bill E-Invoicing Required?

If you have any concerns about the risk factors in your business industry, by the end of this session, everyone will have the opportunity to ask questions, and our experts will provide answers to address your queries.

🆓 Limited seats, first come first serve

Fee: RM 99 → Free, sponsored by SQL Account, others software users are welcome to join

*An e-Certificate of Attendance is provided

Featured Products

We empower more than 600,000 accounting and business professionals using SQL Account and SQL Payroll to perform their daily operation effectively.

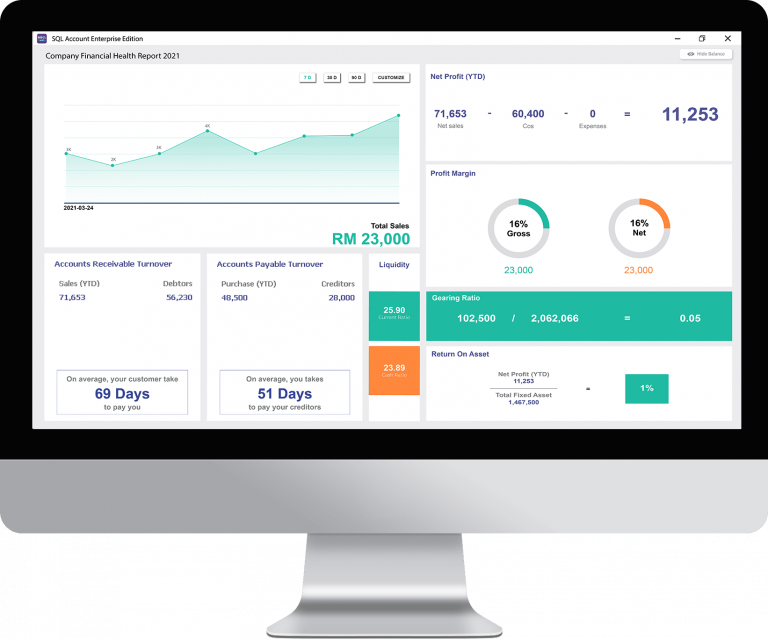

SQL Account

SQL Account is an accounting software that is suitable for all businesses, from small businesses to large organizations. It is crucial to find a business solution that suits the nature of your business. The right accounting software will broaden the horizons and expand business opportunities for you.

Choose the best accounting software in Malaysia for your company. SQL Account is user friendly & can be integrated with no fuss.

Free Download Accounting Software trial to experience our accounting software.

Access Anytime, Anywhere

Batch Emails Statements

Special Industries Version

Real-Time CTOS Company Overview Reports

Advance Security Locks

Intelligence Reporting

SQL Account Popular Add-ons:

If you’re looking for a feature that is not listed here, please let us know or join our ERP Customization Group Discussion for FREE.

Join us and start using the Best Accounting Software in Malaysia!

SQL Payroll

SQL Payroll software brings simplicity into the complex nature of Human Resource management. This payroll software comes equipped with HR management, leave management, PCB tax calculator, and is compliant to Malaysia labour laws & government regulations.

Free Download Payroll Software trial to experience our payroll software.

Certified by Statutory bodies & 100% accurate

electronic submission & e-Payment ready

Batch email payslip

Comprehensive management reports

Unlimited year records

E Leave mobile app

SQL Account is the Best Accounting Software among all. SQL Account is Number 1 Accounting Software in Malaysia.

Our Customers

More than 270,000 companies use SQL Account & SQL Payroll for business daily operation

Our Business Partners

CTOS x SQL

Evaluate your new client before offer any credit terms.

View More

RHB x SQL

Connect your RHB Reflex Premium Plus with SQL Account.

View More

Maybank

Seamlessly connect your Maybank2u, Maybank2u Biz accounts to SQL Account.

View More

ipay88 x SQL

Accelerate your customer payment collection with SQL Account’s eInvoice.

View More

Education Partners

Testimonial

Online Resources

Accountant, when come to Borang B & Borang B submission, a common question may ask from your customers:

I just want tax payable RM 8000 only, how much yearly income do I need to report to LHDN? What us my tax bracket %?

Popular Articles

How SQL Make Your Work-Life Easier?

SQL Account Movie (Warehouse) - How to get Good Incentives

SQL Account Movie (Sales Person) - Deserve to own luxury bags & premium watches

SQL Account Movie (Boss) - 10 months bonus, tripled sales in a quarter

SQL E Leave

SQL E Claim