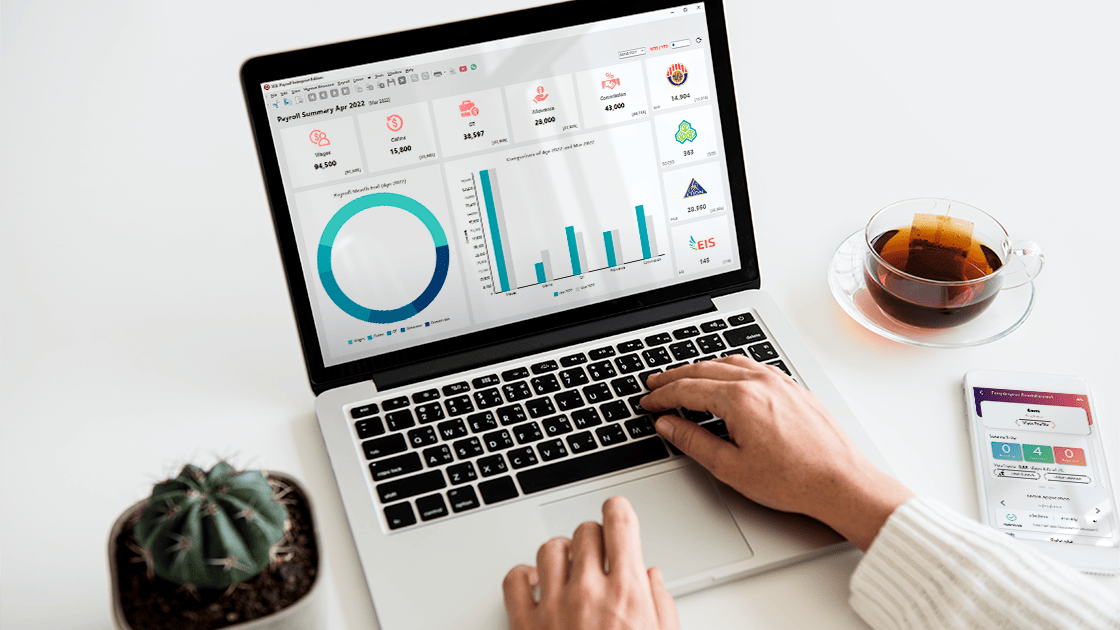

SQL Professional Tax Calculator & Tax Planner Malaysia

for Income Tax

Income Tax Summary YA 2022

Gross Income Before Deduction

40,000

Tax Deductions

- 9,000

Individual / Spouse Relief

9,000

Child Relief

0

Parent Relief

0

Other Relief

0

Taxable Income

31,000

Tax Amount

480

5,000 x 0% = 0 15,000 x 1% = 150 11,000 x 3% = 330 Less Zakat

- 0

Less Tax Rebate

- 400

Tax You Should Pay

RM 80

Average Tax Rate

(80/31,000

) x 100% = 0.2%

|

Income Tax Summary YA 2022

Gross Income Before Deduction

40,000

Tax Deductions

- 9,000

Individual / Spouse Relief

Individual & dependent relatives

9,000

Taxable Income

31,000

Tax Amount

480

5,000 x 0% = 0 15,000 x 1% = 150 11,000 x 3% = 330 Less Zakat

- 0

Less Tax Rebate

- 400

Tax You Should Pay

RM 80

Average Tax Rate

(80/31,000

) x 100% = 0.2%

|

Assessment Year 2022

| Chargeable Income | Calculation (RM) | Rate % | Tax RM |

|---|---|---|---|

|

0 - 5,000 |

On the First 5,000 |

0 |

0 |

|

|

On the First 5,000 |

|

0 |

|

|

On the First 20,000 |

|

150 |

|

|

On the First 35,000 |

|

600 |

|

|

On the First 50,000 |

|

1,800 |

|

|

On the First 70,000 |

|

4,400 |

|

|

On the First 100,000 |

|

10,700 |

|

|

On the First 250,000 |

|

46,700 |

|

|

On the First 400,000 |

|

83,450 |

|

|

On the First 600,000 |

|

133,450 |

|

|

On the First 1,000,000 |

|

237,450 |

|

|

On the First 2,000,000 |

|

517,450 |

Dear SQL users (or non-SQL users yet), thank you for visiting SQL Income Tax Calculator.

Currently LHDN has yet to release the latest tax relief and tax rate for YA 2022.

To estimate your tax, you may use our YA 2021 income tax calculator for the time being.

We will create the best income tax calculator for you once we find out that LHDN has published tax reliefs for the YA 2022. Please notify us as soon as possible if you notice that LHDN has published tax details for the YA 2022 as well.