How to Check E-Invoice Notifications & Dashboard

E-Invoice Notifications

Description

E-Invoice Notifications are alerts or messages you receive from the e-invoicing system (like a government portal or accounting software) related to your electronic invoices. These help you stay informed about the status and issues of your e-invoices in real time.

What E-Invoice Notifications Usually Include:

- Invoice Submission Success

- Confirms your e-invoice was submitted and accepted.

- Check which E-Invoices have been rejected by the buyer

- Alerts you about errors (e.g., wrong GSTIN, missing fields).

- Pending or Processing Status

- Shows that your invoice is still being processed.

- IRN (Invoice Reference Number) Generated

- Confirms that a valid IRN has been created.

- Audit or Review Alerts

- May notify you if your invoice is selected for review.

- Upcoming Deadlines or Reminders

- Reminds you to submit invoices or correct errors before due dates.

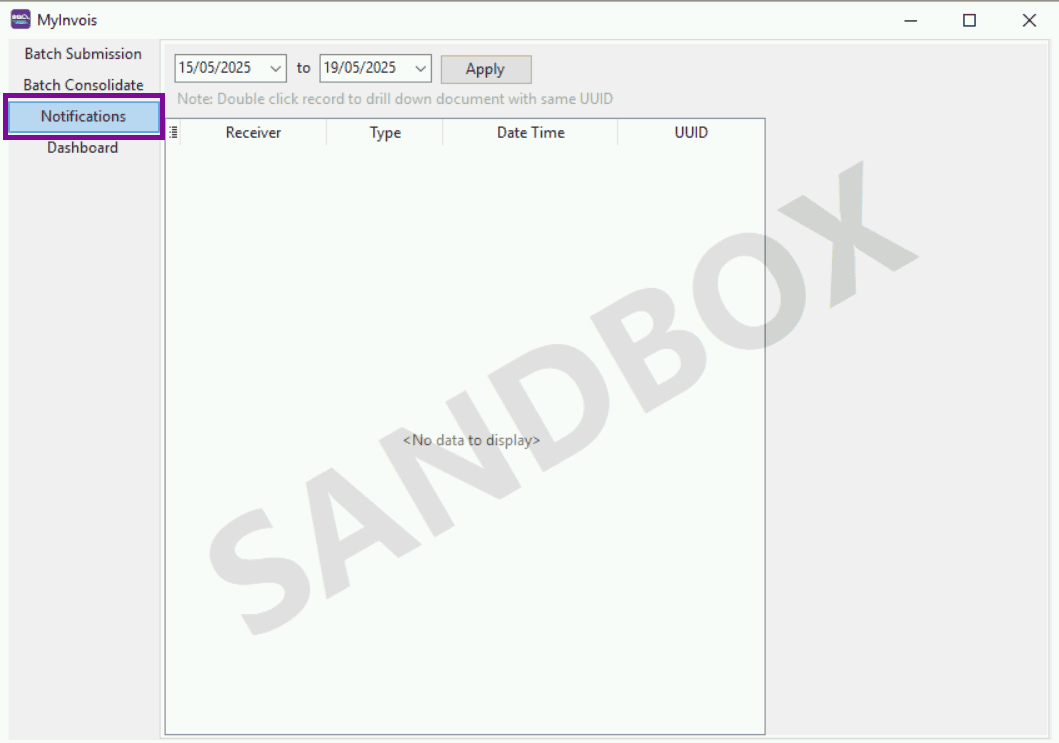

How to check E-Invoice Notifications in SQL?

- Go to ☁, Click MyInvois

- Select Notifications

What features are available in Notification?

You can filter and retrieve data from no more than 120 hours

- Example: 15/05/2025 – 19/05/2025(96 hours)

Click here to enter the MyInvois Portal and view the detailed content of the transaction

When the buyer rejects the E-Invoice you submitted, the UUID will be displayed here

Double-click the UUID to directly navigate to the E-Invoice page, where you can choose whether to cancel the E-Invoice

The right-side page will display the detailed information of all cancelled E-Invoices. You can also scroll down to view more information

E-Invoice Dashboard

Description

An E-Invoice Dashboard is a central, visual interface that shows you an overview of all your e-invoicing activities. It helps you track, monitor, and manage your electronic invoices in real-time.

Think of it like your control panel for everything related to e-invoicing.

How to access E-Invoice Dashboard?

- Go to ☁, Click MyInvois

- Select Dashboard

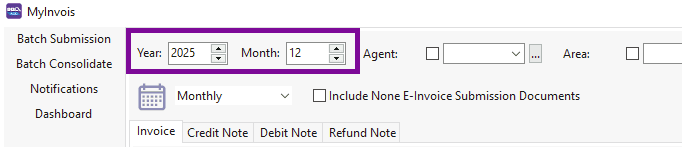

How to use the Dashboard to check E-Invoice status?

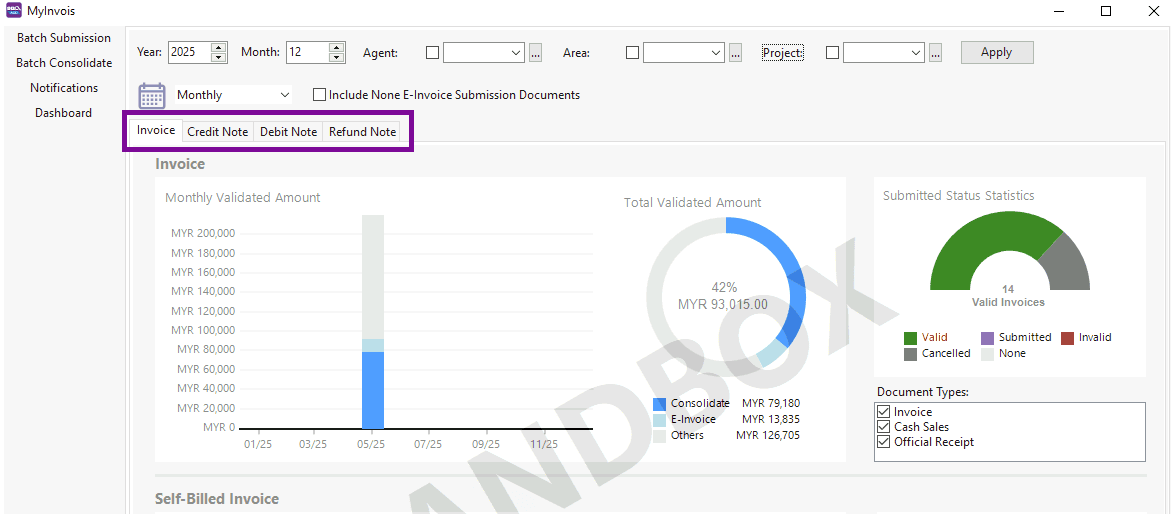

Filter documents by year and month

Note: This refers to the year and month of the submitted E-Invoice

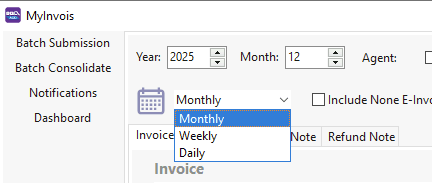

You can change the chart display mode

You can filter the E-Invoice status by Agent, Area, and Project

- Check E-Invoice Status

- Use the Dashboard to see how many invoices have been submitted as E-Invoices by each agent

- Track the number of unsubmitted E-Invoices to prevent any omissions

- Monitor the total invoice amount submitted each month to ensure accurate financial reconciliation

You can also view records of invoices that have not been submitted as E-Invoices to ensure all invoices are checked

You can view analysis reports for Invoice, Debit Note, Credit Note, and Refund Note

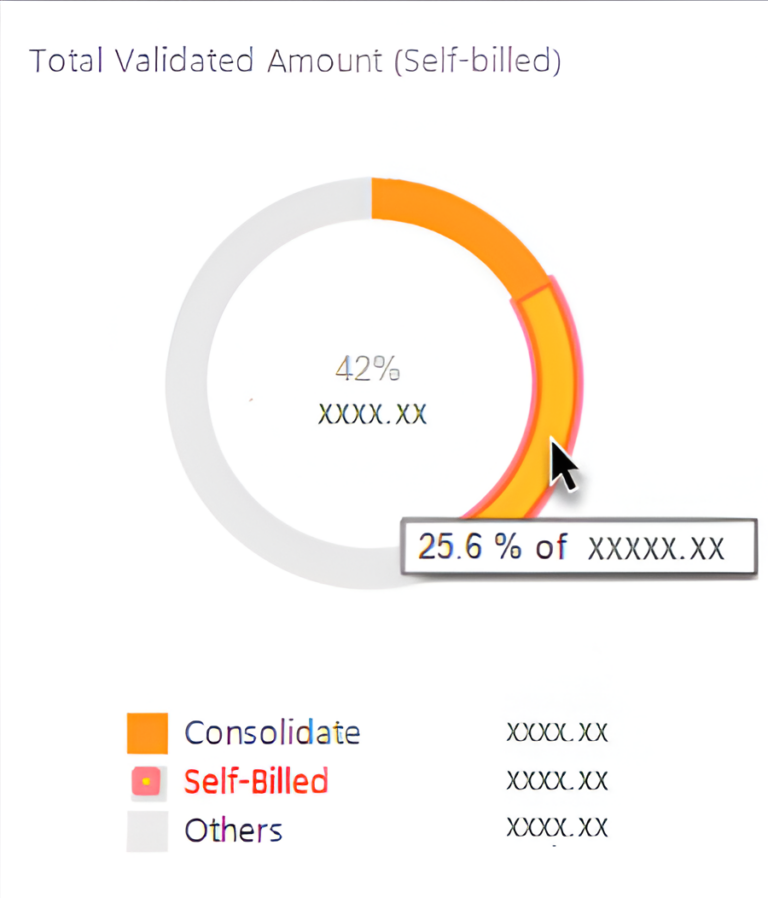

You can view the total amount of Validated E-invoices

Move the cursor over the chart to view the proportion of each data item

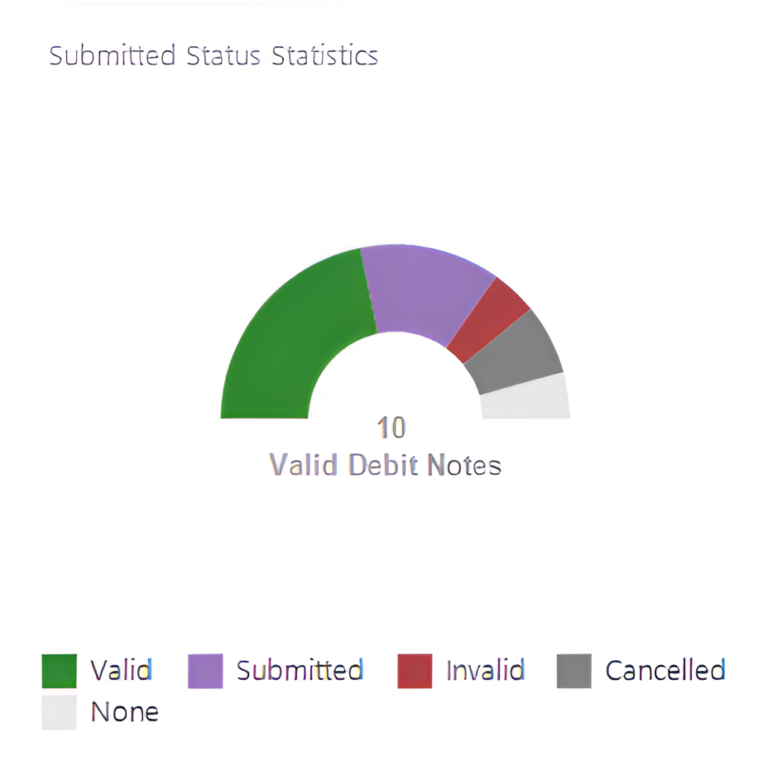

Submission status statistics table

It can be divided into the following 5 statuses:

Valid – Verification successful

Submitted – Submitted successfully + Waiting for verification

Invalid – Verification failed

Cancelled – Cancelled

None – None