How to Issue an E-Invoice for RENT?

How to issue an E-Invoice for Rent?

1. Key Information to Confirm Before Issuing an Invoice

- Landlord’s Entity Type: Is the landlord renting out the property under a company name or as an individual without a management company?

- Landlord’s Invoicing Eligibility: Confirm whether the landlord can issue an E-Invoice by directly inquiring with them.

If the landlord can issue an E-Invoice: Simply obtain the invoice and complete the payment—no additional steps required.

If the landlord cannot issue an E-Invoice: The tenant must issue a Self-Billed E-Invoice to ensure compliance and proper expense documentation.

2. What is a Self-Billed E-Invoice?

- A Self-Billed E-Invoice is an electronic invoice issued by the tenant (payer) in cases where the landlord is unable to provide one.

- This ensures that rental expenses are officially recorded and compliant with financial regulations.

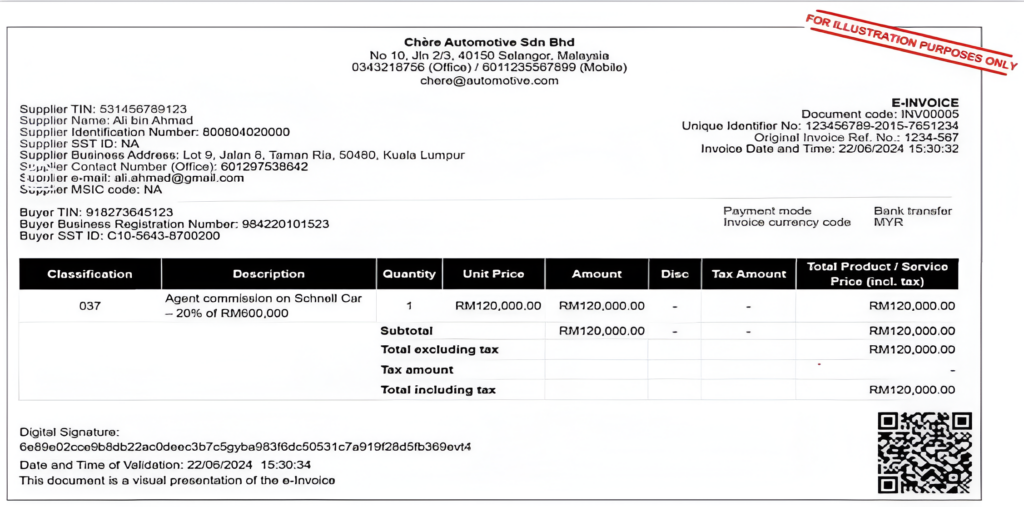

When issuing a Self-Billed e-Invoice, the correct category code must be used.

For rental payments, the standard Category Code 036 (Self-Billed Invoice – Others) applies.

3. How to Issue a Self-Billed E-Invoice

- Verify the number of property owners and their ownership percentages: Allocate the rental amount accordingly and issue separate Self-Billed E-Invoices for each owner

- Obtain necessary information and authorization: This includes the landlord’s TIN Number (Tax Identification Number) and Identity Card (IC) details.

- Generate and submit the Self-Billed E-Invoice: Enter the required details into the invoicing system and submit the invoice for record-keeping.

If the tenant has paid additional expenses on behalf of the landlord (e.g., utilities, service fees), and the original bill is under the landlord’s name, these costs should be included in the Self-Billed e-Invoice to ensure full documentation of expenses.

4. Key Compliance Requirements

- Ensure complete information: The e-Invoice must include landlord’s Tax Identification Number (TIN), Identity Card (IC) number, rental amount, and ownership percentage.

- Timely submission: The tenant must submit the Self-Billed e-Invoice within 7 days after the rental payment to ensure compliance.

Understanding the correct E-Invoice process simplifies rental invoice management.