TIN TYPES in E-Invoice System

Information on Tax Identification Numbers

Section 1 - TIN Description

Tax Identification Number (TIN) or functional equivalent

In Malaysia, both individuals and entities who are registered taxpayers with the Inland Revenue Board of Malaysia (IRBM) are assigned with a Tax Identification Number (TIN) known as “Nombor Pengenalan Cukai”.

TIN will be issued to all Malaysian citizens who attained the age of 18 years old and above.

For the purposes of the CRS, in the absence of TIN or if an account holder fails to provide the financial institution with the TIN for whatever reason, a functional equivalent would be in relation to individual, is the Malaysian National Registration Identity Card Number (NRIC Number). The NRIC Number is a unique 12-digit number issued to Malaysian citizens and permanent residents and is used by the IRBM to identify its taxpayers.

Section II – TIN Structures

1) TIN

The TIN consist of a combination of the TIN Code and set of number as follows:

| Category | Example |

|---|---|

| Individual TIN | IG115002000 IG4040080091 IG56003500070 |

Non-Individual TIN:

| Category | TIN Code | Example | |

|---|---|---|---|

| 1 | Companies | C |

C20880050010 D4800990020 E91005500060 F10234567090 |

| 2 | Cooperative Societies | CS | |

| 3 | Partnerships | D | |

| 4 | Employers | E | |

| 5 | Associations | F | |

| 6 | Non-Resident Public Entertainers | FA | |

| 7 | Limited Liability Partnerships | PT | |

| 8 | Trust Bodies | TA | |

| 9 | Unit Trusts/ Property Trusts | TC | |

| 10 | Business Trusts | TN | |

| 11 | Real Estate Investment Trusts/ Property Trust Funds | TR | |

| 12 | Deceased Person’s Estate | TP | |

| 13 | Hindu Joint Families | J | |

| 14 | Labuan Entities | LE |

The earlier version of TIN is presented differently and to demonstrate the changes of TIN, please refer to the table below:

| Category | Earlier version of TIN | TIN (Effective 2 January 2023) | Remarks |

|---|---|---|---|

| Individual | SG115002000 SG4040080091 OG56003500070 |

IG115002000 IG4040080091 IG56003500070 |

The prefix SG/OG converted to IG The numeric characters remain unchanged |

| Non Individual | C2088005001 D480099002 E9100550006 F1023456709 |

C20880050010 D4800990020 E91005500060 F10234567090 |

The number “0” has been added at the end of the existing TIN |

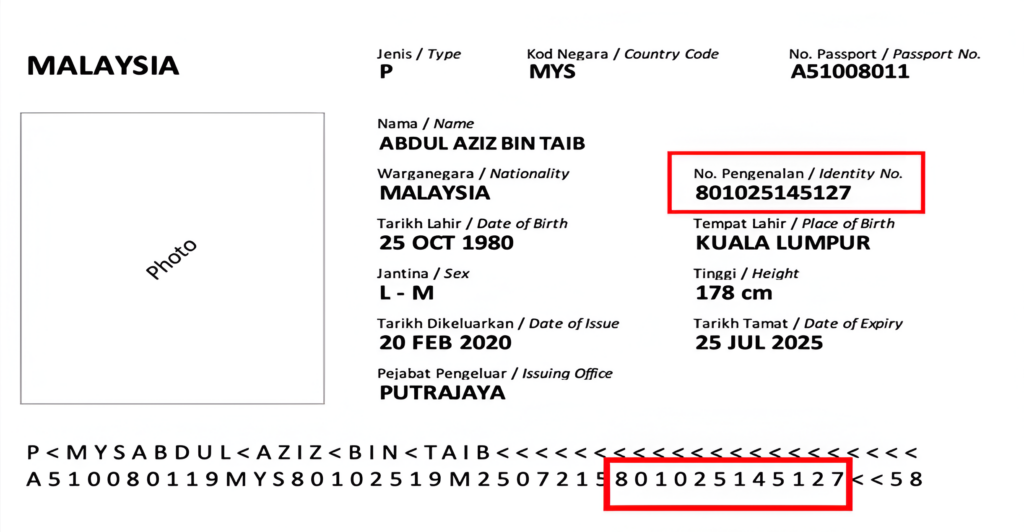

2) NRIC Number

The format of the NRIC Number features 12 digits appears on the Malaysian Passport.

Section III – Where to find TINs?

A Malaysian tax payer can check their TIN on the front page of his individual income tax return or through MyTax Portal at https://mytax.hasil.gov.my under “e-Daftar” menu.

Meanwhile, a functional equivalent to TIN, would be the NRIC Number which can be found in the second page of the Malaysia Passport. See example in the red box below:

Section IV – TIN Information on the domestic website

For more information about CRS Requirement on TIN, please visit our CRS Portal via this link.

Checking for TIN can also be done through:

a) Via online through MyTax at the following link: https://mytax.hasil.gov.my ;

b) HASiL Live Chat;

c) HASiL Care Line at +603-8911 1000 / +603-8911 1100 (Overseas);

d) Customer Feedback Form at HASiL’s Official Portal; or

e) Nearest HASiL Branch.

Section V – Contact point for further information

Malaysia Competent Authority:

Department of International Taxation

Headquarters of Inland Revenue Board of Malaysia

Level 12, Menara Hasil, Persiaran Rimba Permai

Cyber 8, 63000 Cyberjaya, Selangor,

MALAYSIA.

Telephone (+603) 8313 8888 Ext 21400/ 21201/ 21202

Fax: (+603) 8313 7848/ (+603) 8313 7849

Email: eoimalaysia@hasil.gov.my

Reference from:

https://www.hasil.gov.my/media/1iblexbc/malaysia-tin.pdf