Can an E-Invoice be Modified or Deleted?

Can an E-Invoice be modified or deleted? YES!

Can an E-Invoice be modified or deleted?

Yes! But the method depends on whether the E-Invoice is already Validated and whether it’s within or after 72 hours of submission.

Supported E-Invoice Document Types:

- Invoice

- Credit Note

- Debit Note

- Refund Note

- Self-billed Invoice

- Self-billed Credit Note

- Self-billed Refund Note

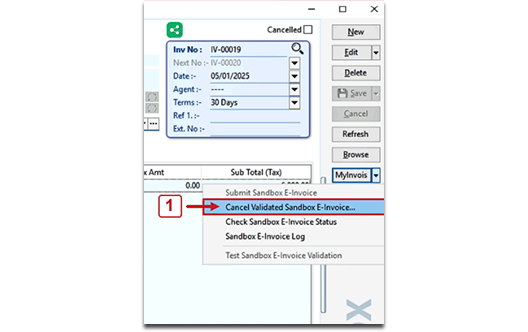

Within 72 Hours – Modify or Cancel a Validated E-Invoice

If the E-Invoice was validated within the last 72 hours, you can cancel and edit it directly.

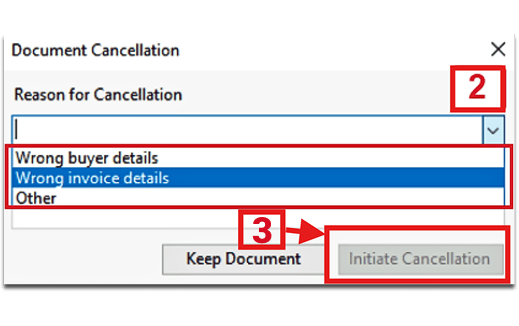

- Go to MyInvois, choose “Cancel Validated E-Invoice”

- Select the invoice and state the reason for cancellation

- Click “Initiate Cancellation”

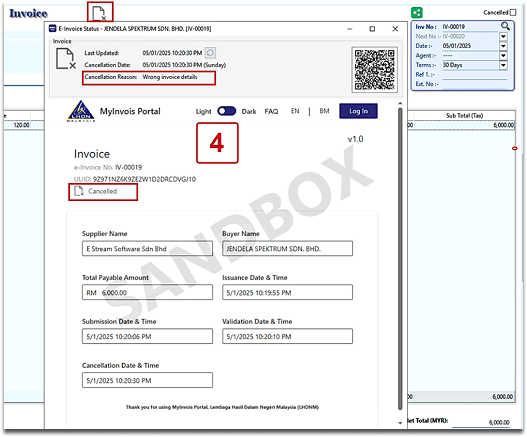

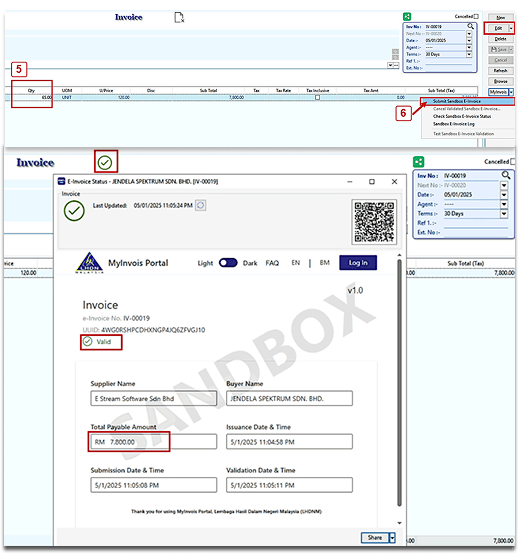

- Once cancelled, the invoice status will update and allow you to edit it

- After editing, click “Submit E-Invoice” to resend to LHDN

After 72 Hours – Modify via Credit Note

If the E-Invoice has been validated for more than 72 hours, you cannot directly cancel or edit it. Instead, use a Credit Note to make corrections.

✨ Method 1: Create New Credit Note (For non-stock related issues)

Use when:

- Discount or pricing errors

- No stock/inventory is involved

✨ Method 2: Transfer to Credit Note / Transfer from Sales Invoice (For stock-related issues)

Use when:

- Items are returned or stock quantity is incorrect

Method 1: Create New Credit Note (For non-stock related issues)

Use when:

- Discount or pricing errors

- No stock/inventory is involved

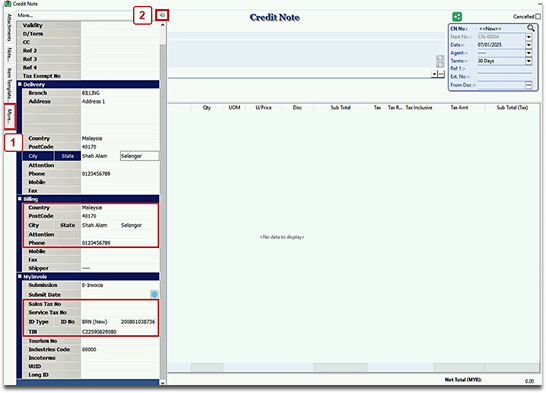

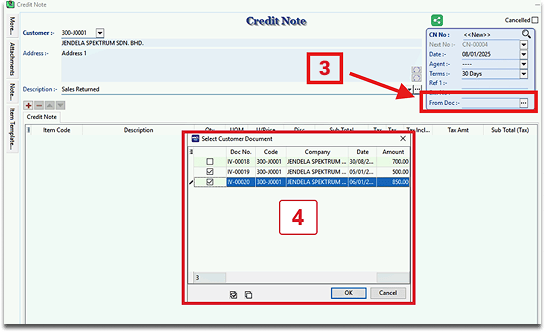

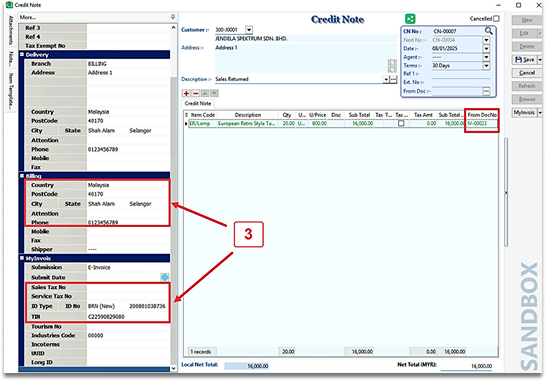

- Go to the Sales Credit Note page.

- Click on “More” at the top right and select “Credit Note”.

- On the page, click the “From Doc +…” button.

- The system will display related Invoices and Cash Sales for the customer.

- Select the Invoice(s) or Cash Sales document(s) to cancel or adjust.

- The selected document data will be automatically imported into the Credit Note.

- Verify all details, then click “Submit E-Invoice” to submit the new e-invoice.

Method 2: Transfer to Credit Note / Transfer from Sales Invoice (For stock-related issues)

Use when:

- Items are returned or stock quantity is incorrect

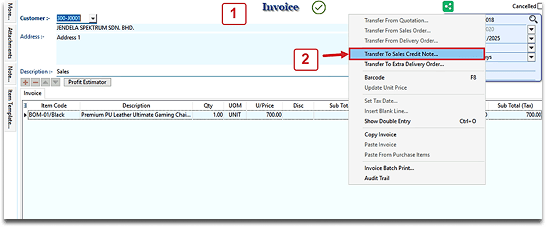

- Open Original Sales Invoice

- Locate the validated invoice (older than 72 hours)

- Transfer to Credit Note

- Option A: Use “Transfer to Sales Credit Note” from the invoice.

Transfer to Credit Note

- Transfer to Credit Note

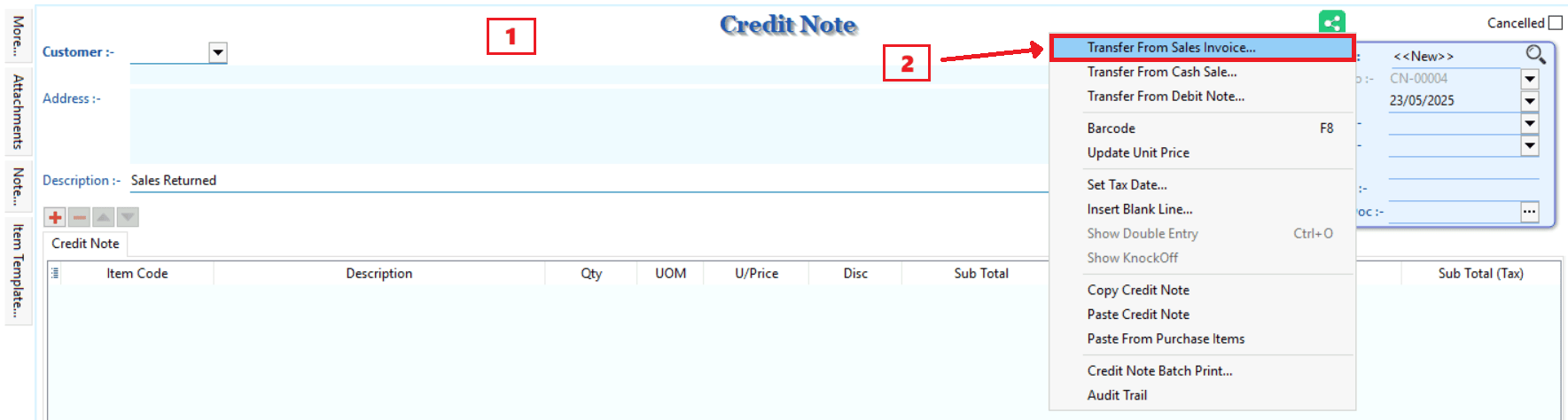

- Option B: Go to Credit Note → “Transfer from Sales Invoice”.

Transfer from Sales Invoice

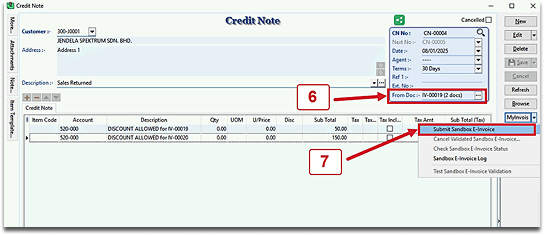

- Edit Credit Note

- Adjust item quantity or details.

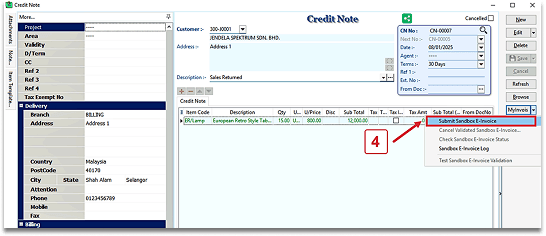

- Confirm the linked invoice in “From Doc No”.

- Submit to LHDN

- Click “Submit E-Invoice” to send the correction.

Share This Page

Share

Tweet

Related Posts