SUBMIT E-INVOICE

E-Invoice is a new tax system implemented by the Malaysian government to improve the transparency and efficiency of tax filing.

Steps to Submit E-Invoice

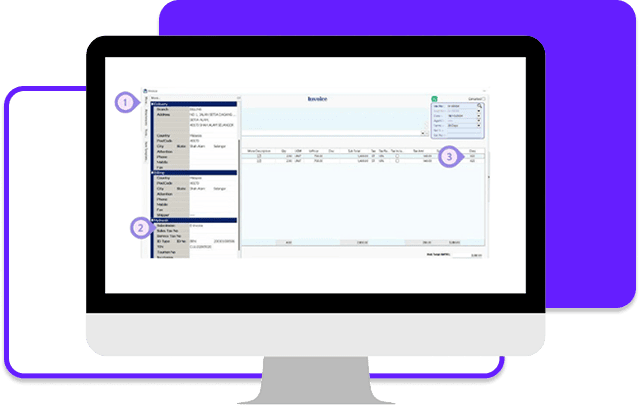

STEP 1

- Open the system as usual (Sales – Invoice – New)

- All preset information in the customer profile (Maintain Customer) will be automatically retrieved. Additional details can be edited on the More tab

- Classification will be automatically retrieved from Maintain Stock Item If needed, modifications can be made here

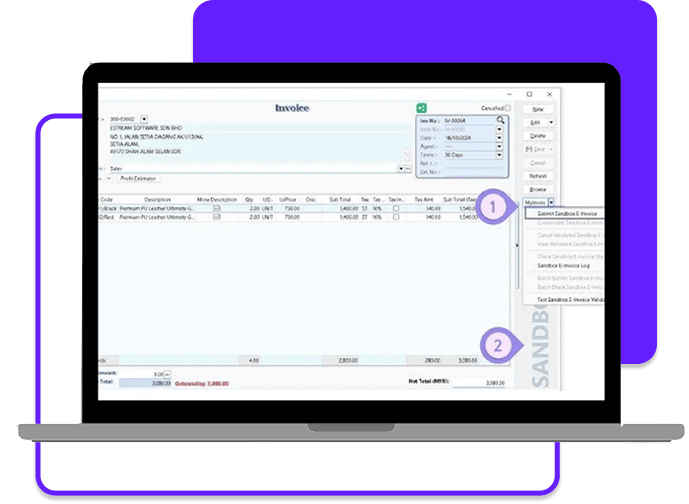

STEP 2

- Click MyInvois - Submit Sandbox E-Invoice to submit.

- Sandbox refers to the current connection is connected with LHDN MyInvois Prepod test server.

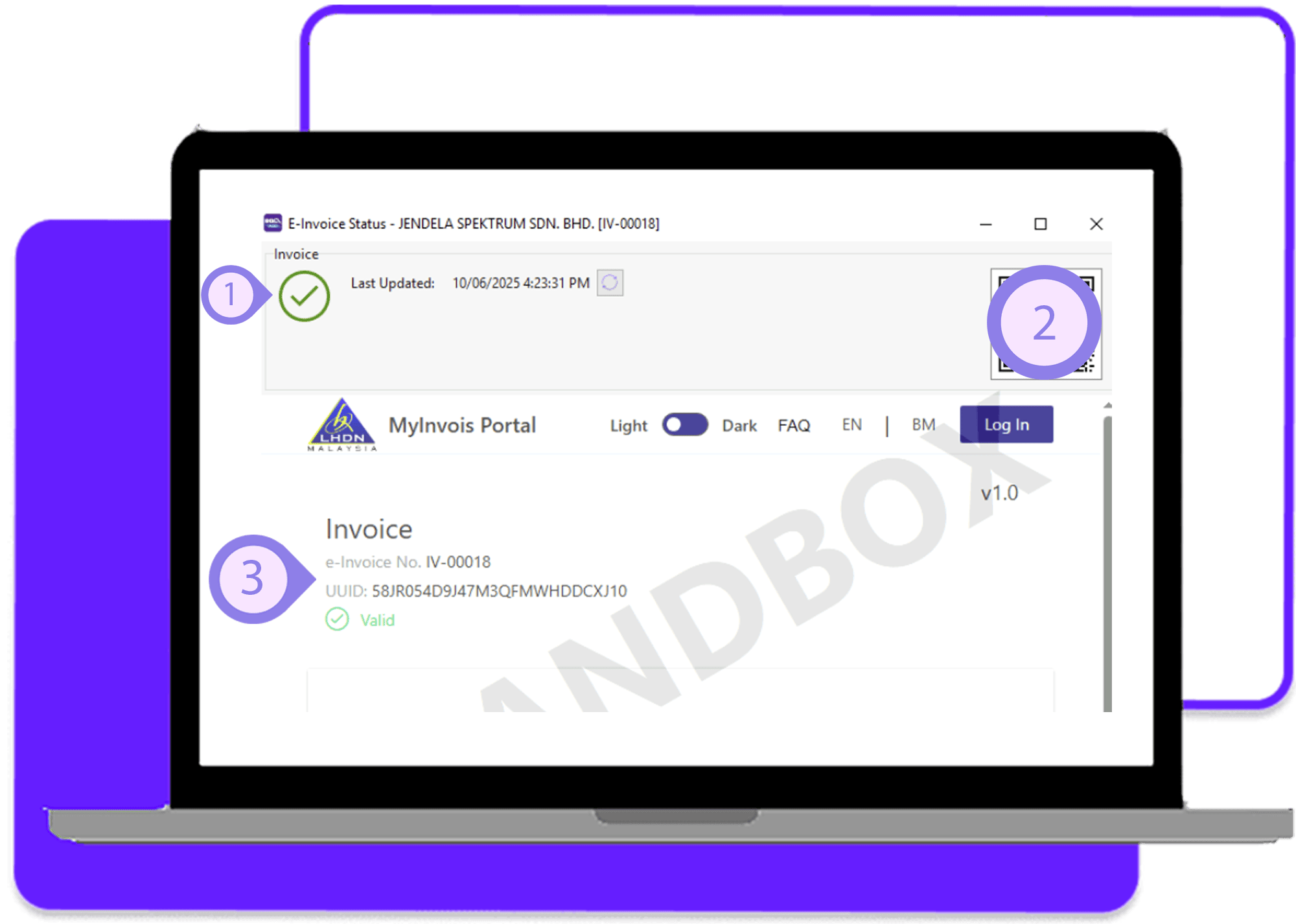

STEP 3

- E-Invoice Status = Submitted / Valid / Invalid / Cancelled

- A validated e-invoice will have a QR code, which can be used to verify the existence and status of the e-invoice via MyInvois

- Internal Invoice Number UUID – Generated by LHDN and used for search purposes

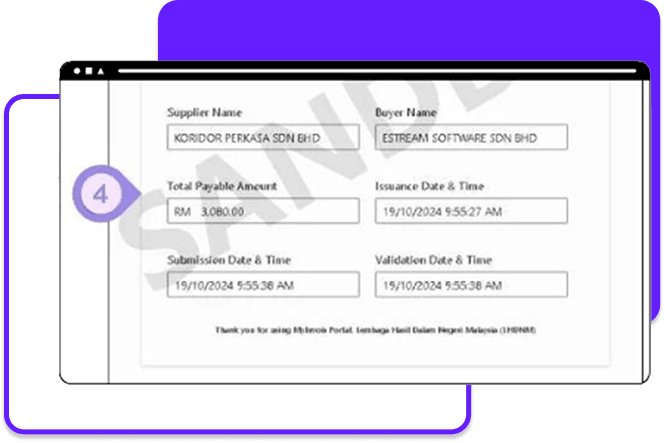

- Supplier & Buyer Information, Total Invoice Amount, Document Issuance, Submission & Validation Date and Time (Displayed in UTC format)

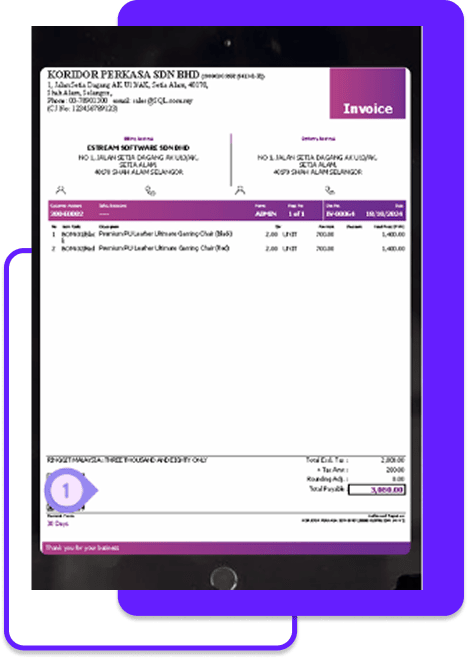

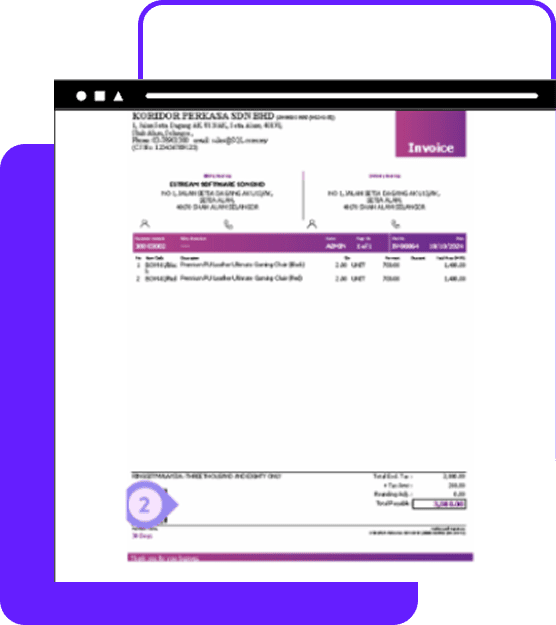

STEP 4

- Once the invoice is validated, the SQL format preview will include the QR code, which will be printed together

If you wish to modify the current format to include the QR code, please contact your service consultant for design customization

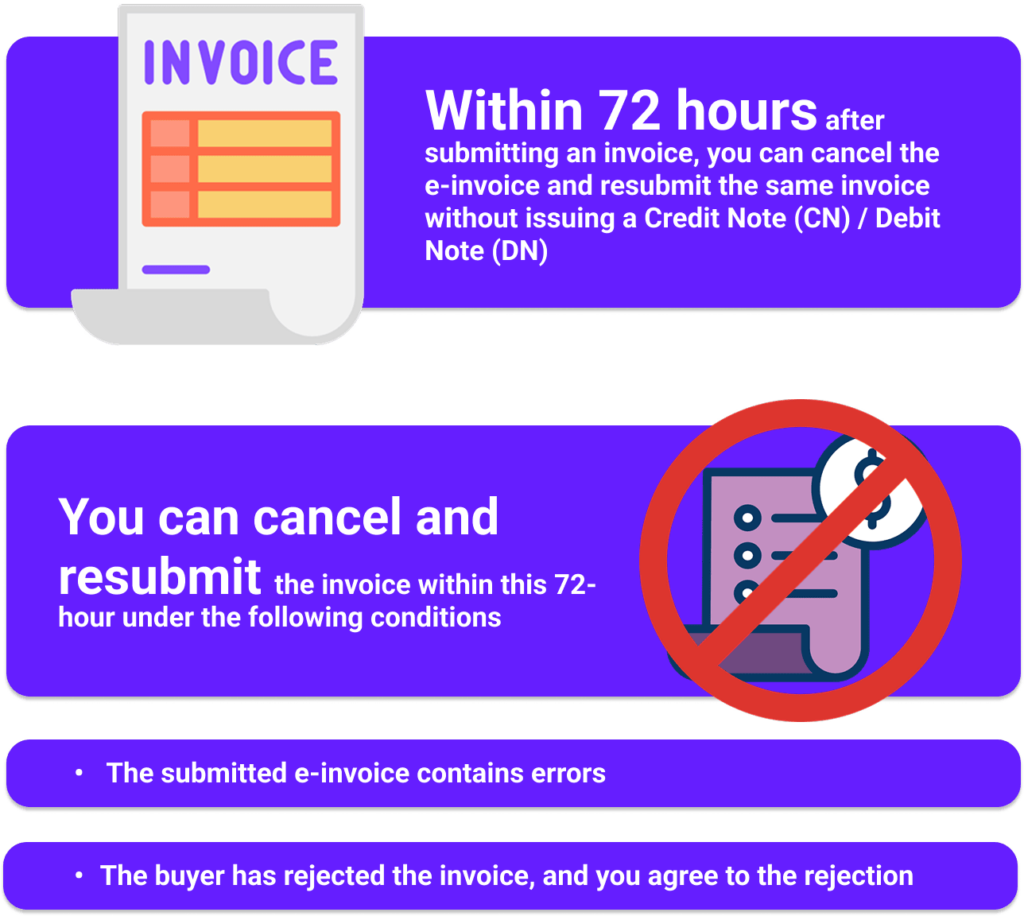

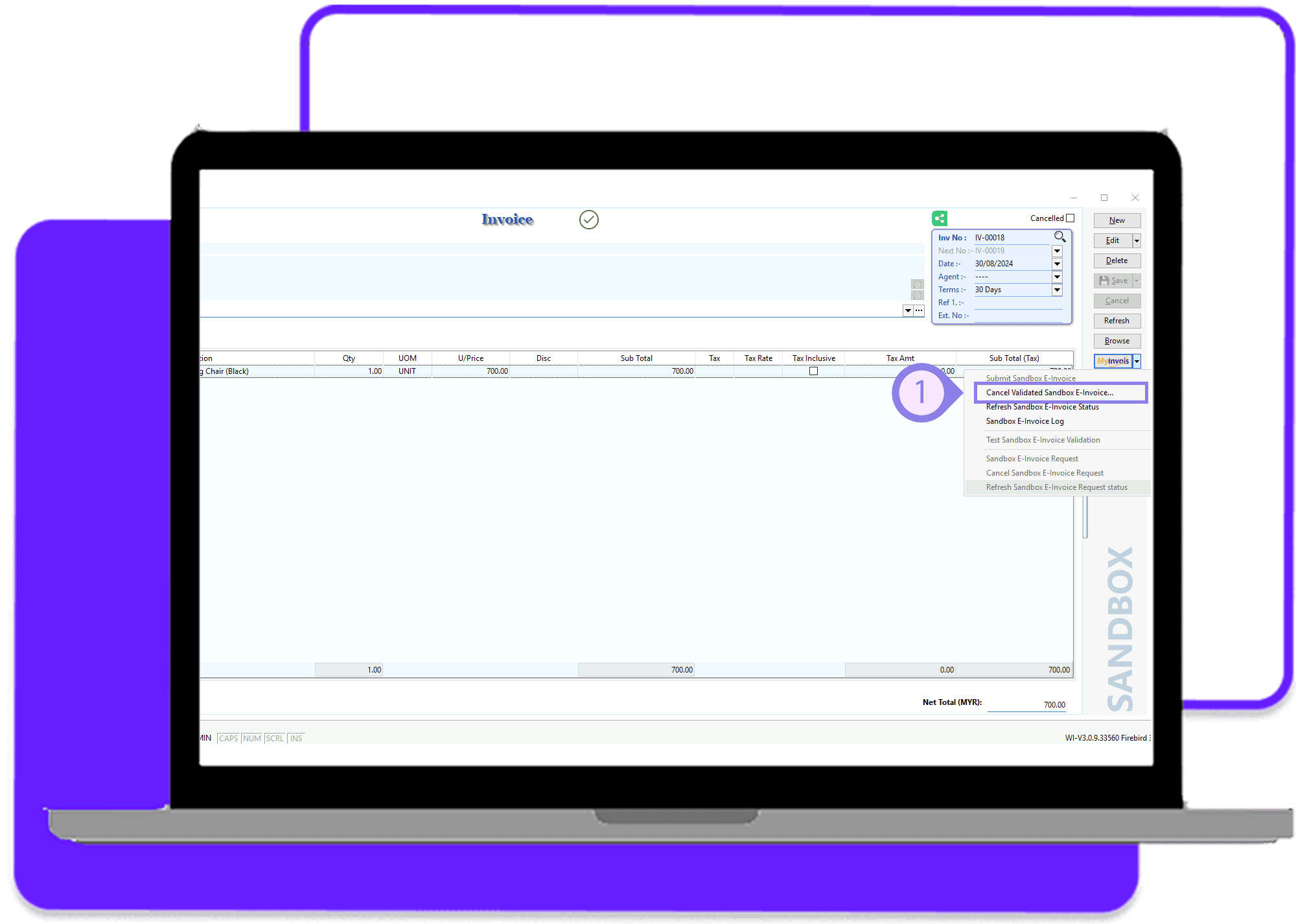

Steps to Cancel a Validated E-Invoice

STEP 1

- Go to MyInvois – Select Cancel Validated E-Invoice

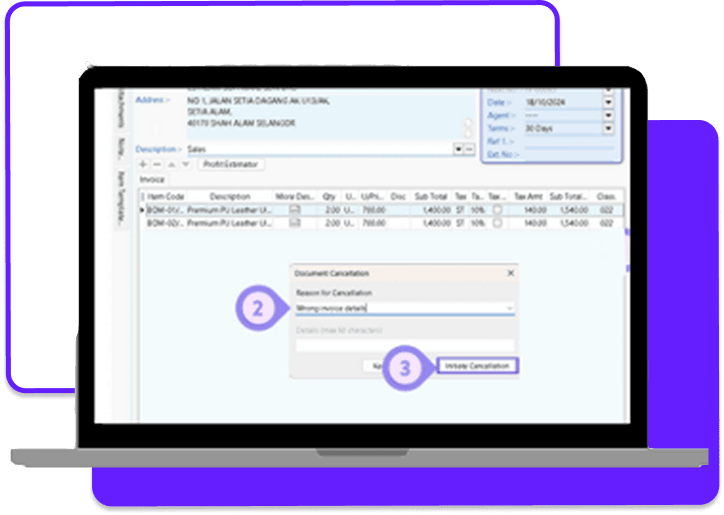

- Provide a reason for cancellation

Confirm and submit the cancellation request

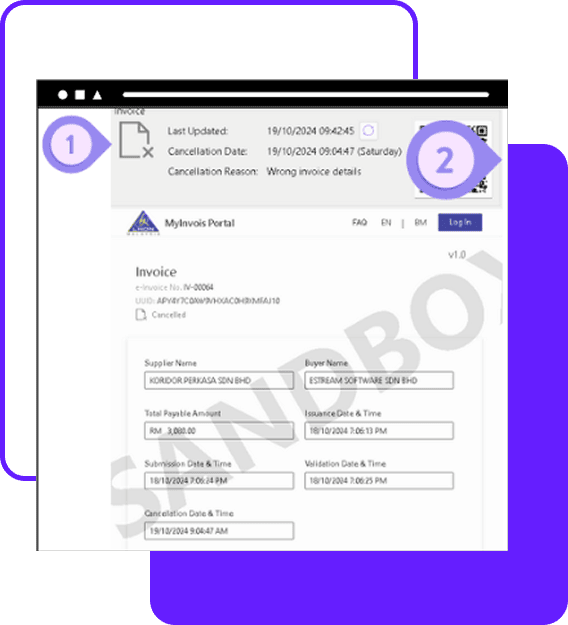

STEP 2

- After submitting the e-invoice cancellation, the QR code on the invoice format will be updated with a new UUID

- When the buyer scans the updated invoice, they will be able to view the cancellation details

Share This Page

Share

Tweet

Related Posts