What is Employee Retention Programme (ERP)?

Employee Retention Programme / Program Pengekalan Pekerjaan is an immediate financial assistance worth RM600 monthly for employees who have been instructed to take unpaid leaves due to the Covid-19 pandemic.

what is Employee Retention Programme (ERP)?

Employee Retention Programme / Program Pengekalan Pekerjaan is an immediate financial assistance worth RM600 monthly for employees who have been instructed to take unpaid leaves due to the Covid-19 pandemic.

- Private sector employees (inclusive of part time workers) who are registered and contribution for Employment Insurance System (EIS) / Sistem Insurans Pekerjaan (SIP).

- Employees with a monthly salary of RM 4000 and below.

- Execution of Notice of Unpaid Leave with a minimum of 30 days between 1 to 6 months (unpaid leave notice must be issued starting from 1 march 2020)

- Between 1 to 6 months based on the period of the unpaid leave notice given by the employer.

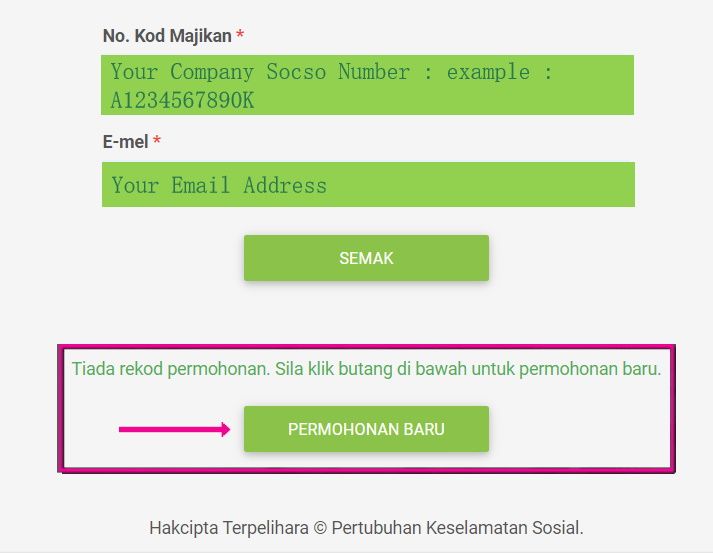

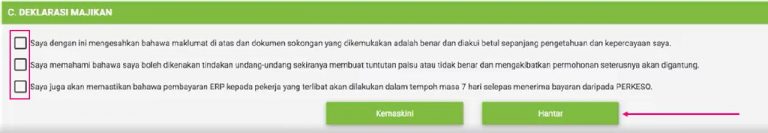

- Application must be done by the employer starting from 20 March 2020 by online https://prihatin.perkeso.gov.my/.

- Payment for ERP will be credited to the employees through the employer withing 7 days after receiving the payment from PERKESO

Step To Claim Wages Subsidy Program (WSP)

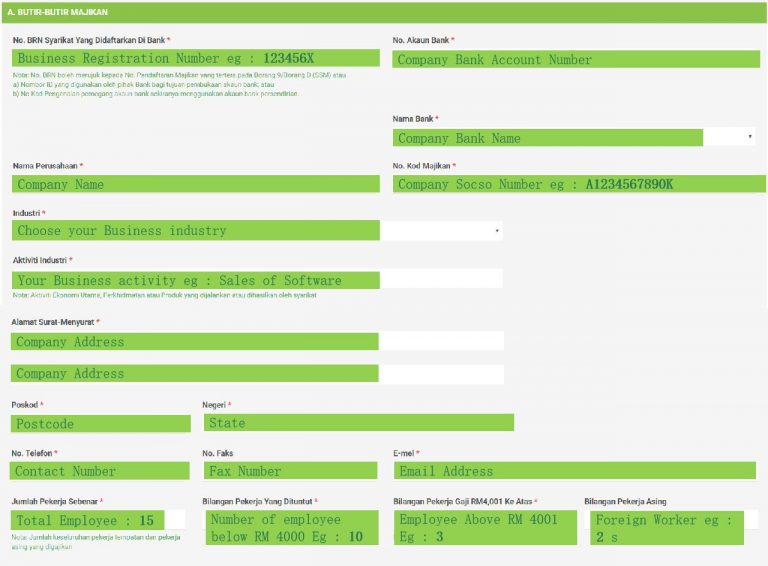

Fill in all employer detail that required*

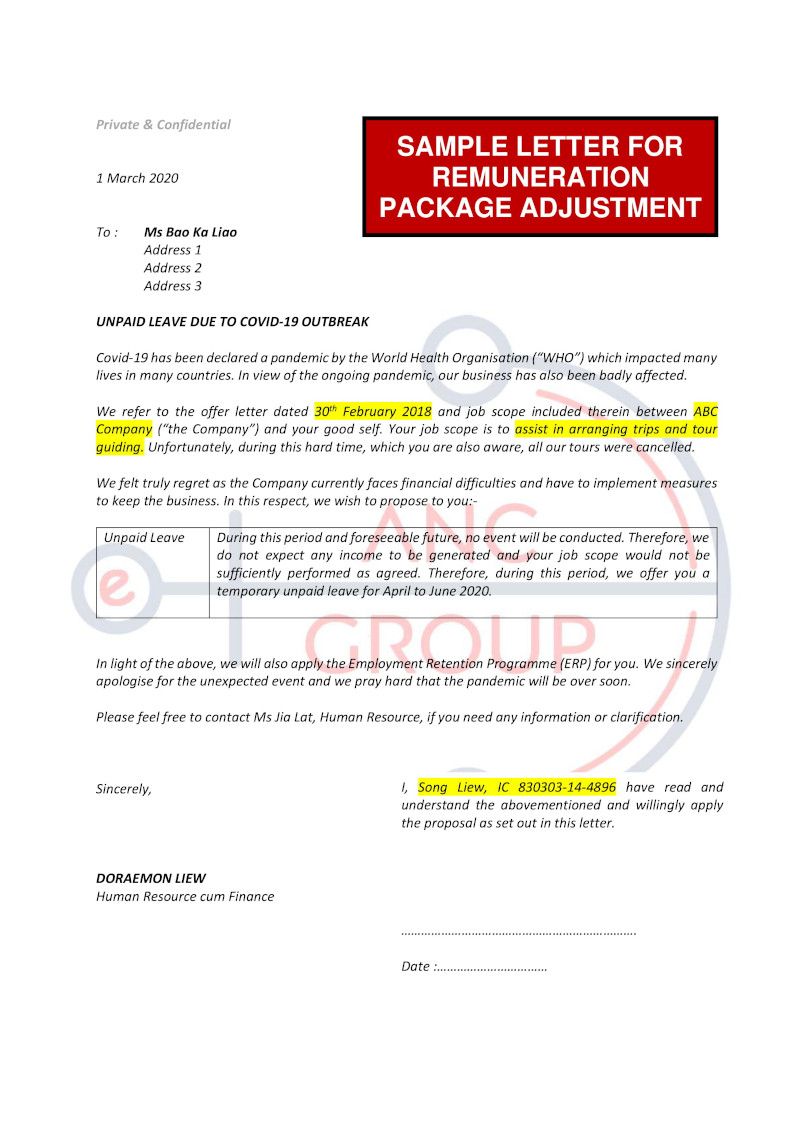

- A) Notice of Unpaid Leave Letter (PDF)

Click here to download the format.

The information needs to take note:

- Propose to take unpaid leave

- Unpaid leave date period

- Employer will help to apply for an Employment retention program

- Employee Sign with IC

- Every company has a different labor contract, please refer to your consultant for more detail of the letter.

- Special thanks to Anc Group – Mr. Song sample letter of remuneration package adjustment.

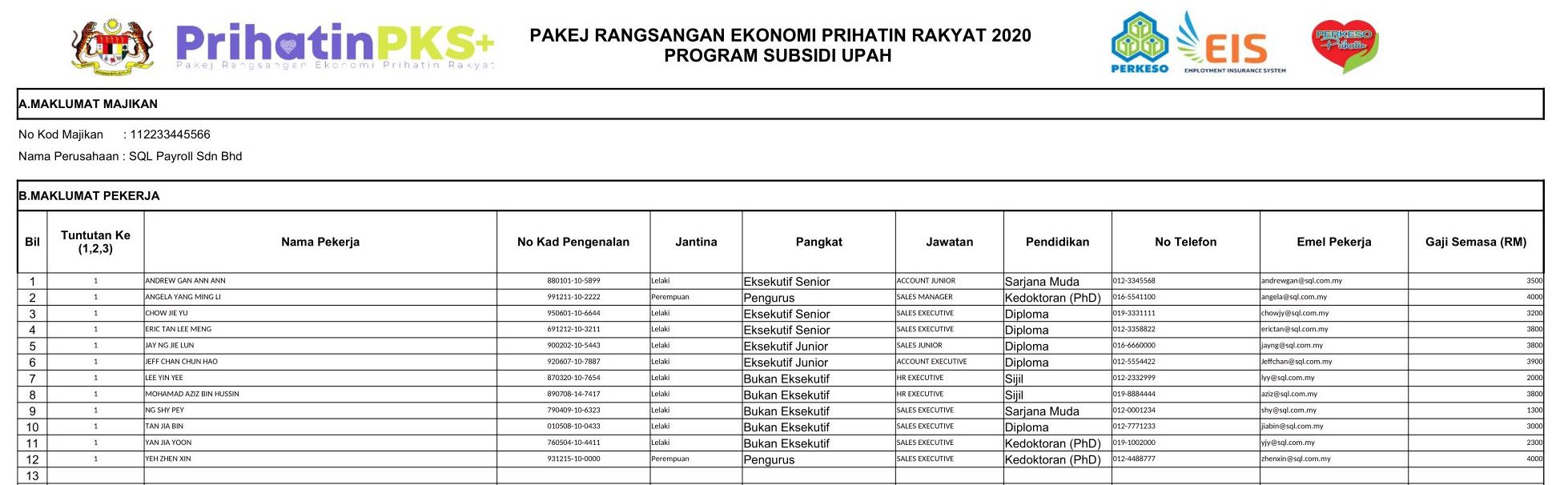

- B) Attachment of Employee List

Click here to download the format & fill in manually.

Column Explanation

| No Tuntutan Ke (1,2,3) | 1 = 1st Time Apply, 2 = 2nd Time Apply |

| Name Pekerja | Employee Name |

| No. Kad Pengenalan | Identification Number (I.C No) |

| Jantina | Gender |

| Pangkat | Rank/ Level |

| Jawatan) | Position |

| Pendidikan | Education |

| No. Telefon | Contact Number |

| Email Pekerja | Employee email address |

| Gaji Semasa (RM) | Current Salary (Include OT, Commission, Bonus, Gross Salary) |

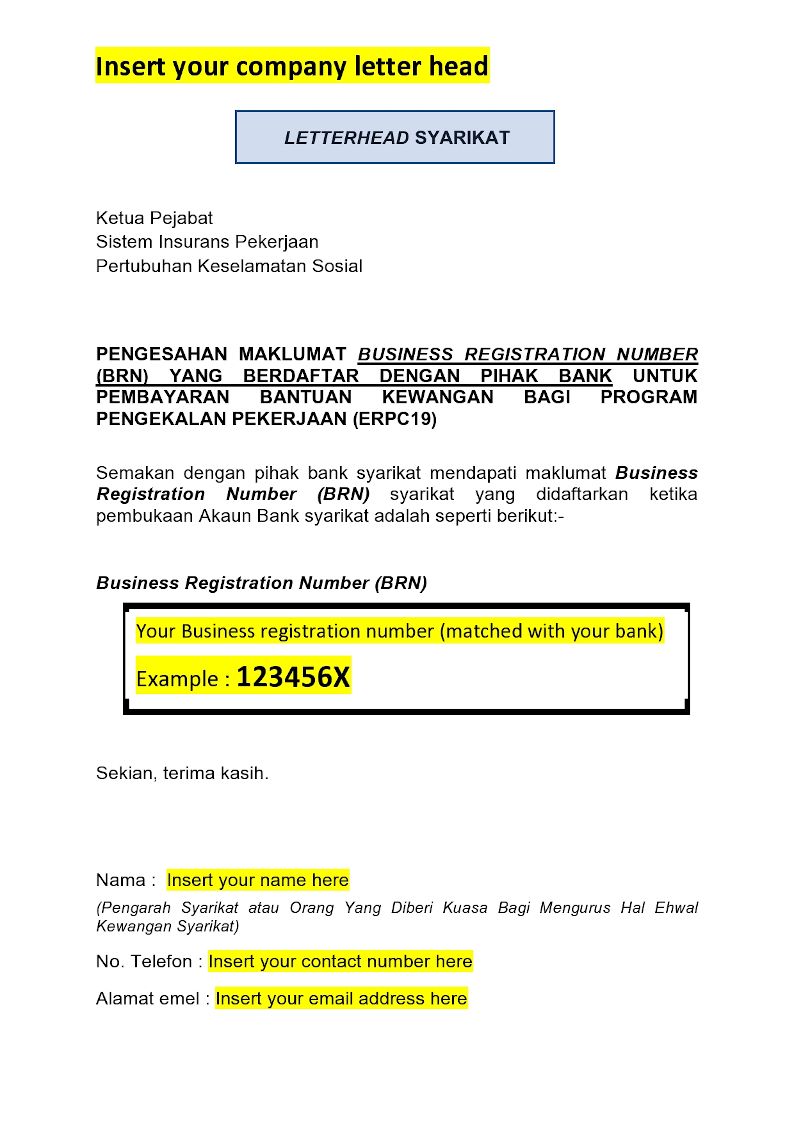

- C) Bank ID/ MyCOID identification No.

Click here to download the format.

Refer description of this posting to download the sample format.

* The format need to save as PDF for upload purpose.

- d) Bank Statement

Save as PDF format for upload purpose.

FAQ Employee Retention Programme (ERP)

- What should I do if my company's application for WSP is approved?

Employers can claim the subsidy from SOCSO given that they have paid their employees their full salary. Employers must still contribute monthly for their employees’ SOCSO and EIS payments based in the employee’s actual salary amount

- Can I apply for both the Employment Retention Programme (ERP) and the wage subsidy programme (WSP) at the same time?

Employers whose application for ERP has been approved can also apply for the wage subsidy programme if their companies meet the wage subsidy guidelines.

But employers cannot apply for ERP and wage subsidy for the same employee for the same month.

- Do I still need to pay my employees their full salary if my application for WSP has been approved?

Yes, employers still need to pay their employees full salary.

- If there was an agreement between the employees and the employer to take Unpaid Leave or to have a salary deduction in order to keep the business running, does the company still qualify for WSP?

No. This is not allowed based on the eligibility requirement given for WSP.

SQL Accounting Software Favoured Features

Access Anytime, Anywhere

Batch Emails Statements

Special Industries Version

Real-Time CTOS Company Overview Reports

Advance Security Locks

Intelligence Reporting

SQL Payroll software Favoured Features

Certified by Statutory bodies & 100% accurate

electronic submission & e-Payment ready

Batch email payslip

Comprehensive management reports

Unlimited year records