Withholding Tax for Agents

A 2% Withholding Tax (WHT) will be imposed to agents, dealers and distributors whose commissions surpasses RM100,000 within 1 year. This ruling takes in effect as of 1st January 2022. The 2% withholding tax is charged on the sales, services, transactions and programs carried out by the agents, dealers, and distributors.

Company must submit their Form CP107D and agents must have a registered tax number in order to declare WHT.

withholding tax FAQ

- What incomes are included in the WHT declaration?

All commissions and incentives in forms of cash that are obtained from sales, transactions or programs made by the agent / wholesalers / suppliers

- How is the RM100,000 commission threshold obtained?

The RM100,000 threshold is access in 2 ways. Which is by company and by year:

- By company:

Eg. Agent XY received a RM108,000 commission from Company AA and a RM90,000 commission from Company BB. In this year, Agent XY, needs to contribute 2% WHT to Company AA but not Company BB.

- By year:

Eg. If Agent Z reaches the RM100,000 threshold in 2022, they will need to contribute WHT in 2023.

** Important note: RM100,00 threshold is checked each year and NOT on a one-time basis.

- When does the company need to pay WHT?

The company needs to submit the 2% WHT to LHDN within 30 days of payment to the agents.

- Will the 2% Withholding tax appear in CP58?

Yes, the updated CP58 will allow companies to declare WHT.

- If the agent has submitted form CP500, is this 2% Withholding tax still applicable?

Yes.

- If commission for December 2021 is made is January 2022, is it still eligible for WHT?

Yes, it will be declare in CP58 2022 if the total commission for 2021 amounts to more than RM100,000.

- Will I be penalized for failing to declare WHT?

Yes, a company that fails to remit the 2% within the stated time period, a 10% late payment penalty (10% of the unpaid tax) will be imposed.

- Where can I get the Form CP107D?

A company download the form at LDHN portal or directly print from SQL Account with few simple clicks and distribute to their agents.

How to Print CP107D & Lampiran CP107D from SQL Account?

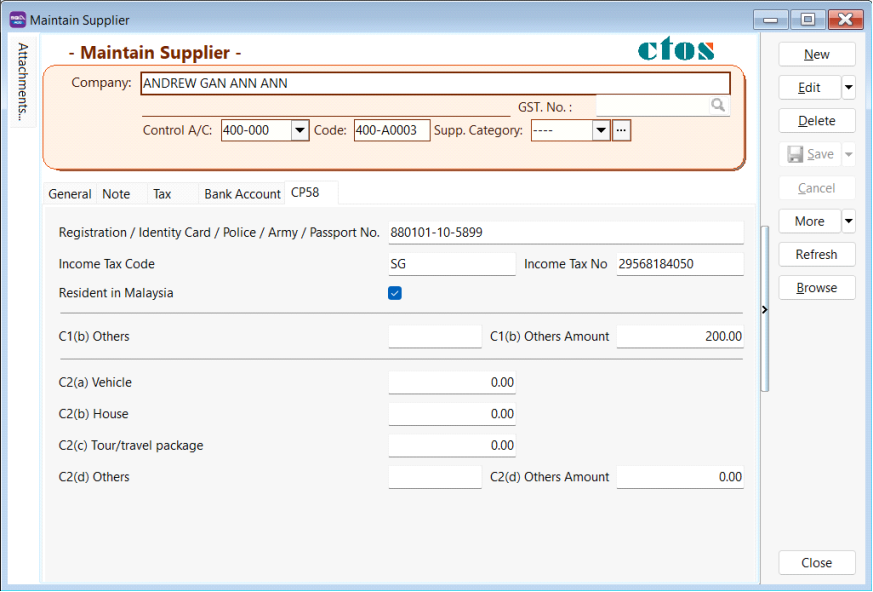

Go to Supplier > Maintain Supplier, you can fill up the agents information such as IC number, Income Tax Number and others information in CP58.

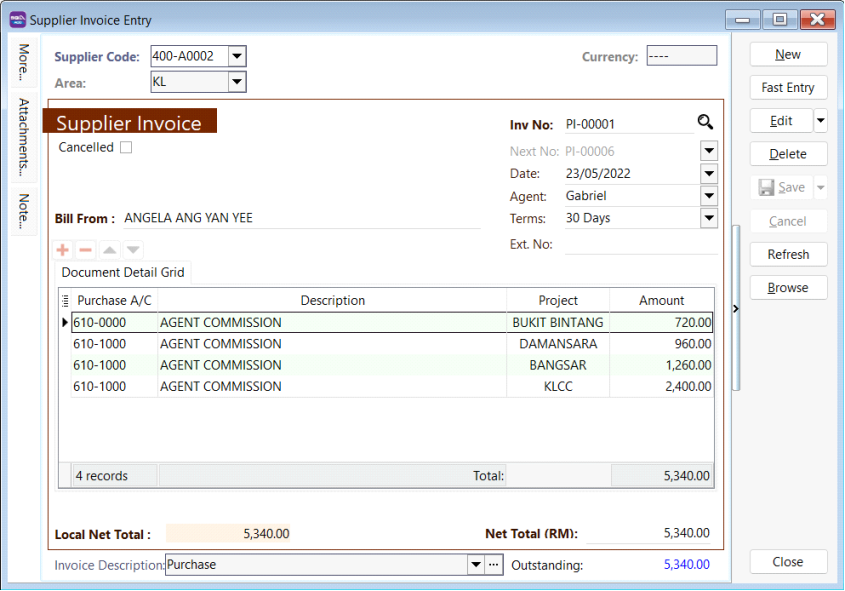

Issue invoices for agent commission from Supplier > Supplier Invoice.

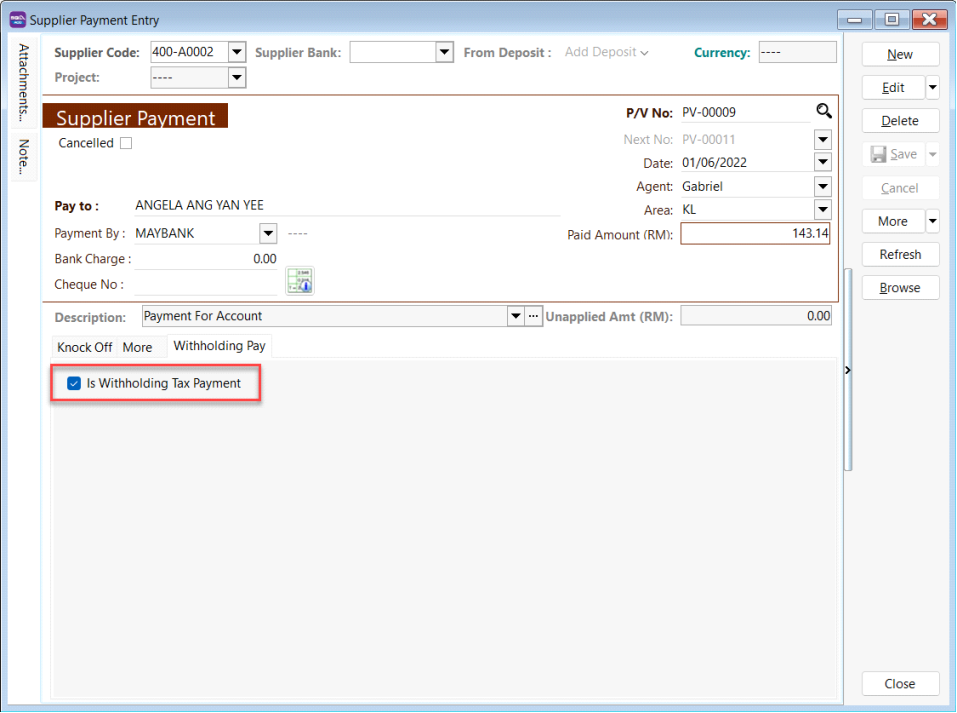

For payment to agent, go to Supplier > Supplier Payment, insert the amount and information, tick on withholding tax payment.

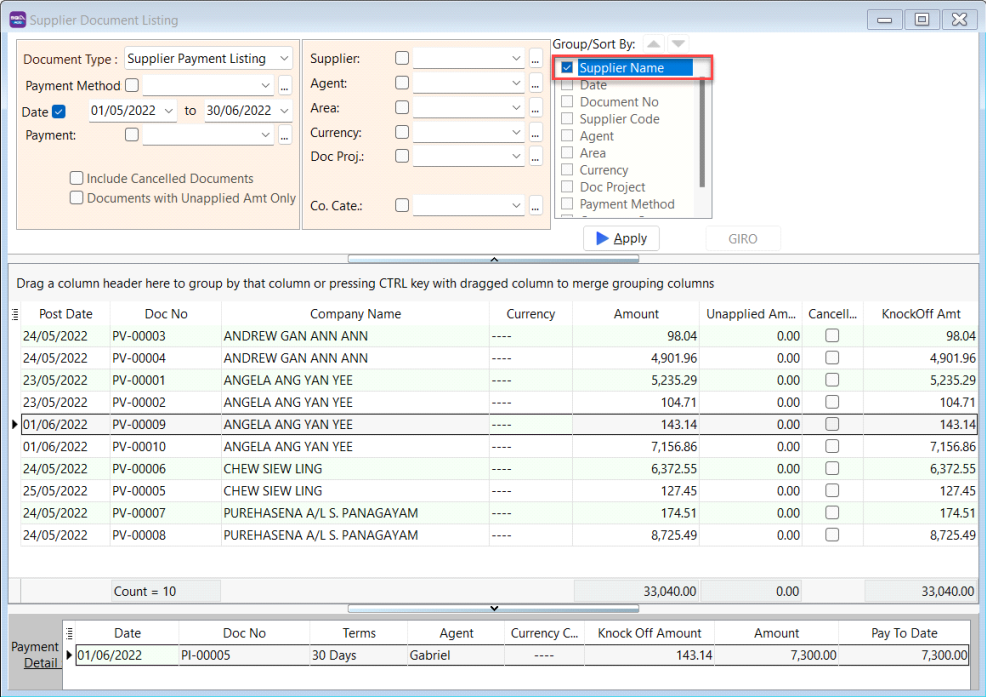

Print CP107, CP107(D), CP58 from Supplier > Supplier Document Listing

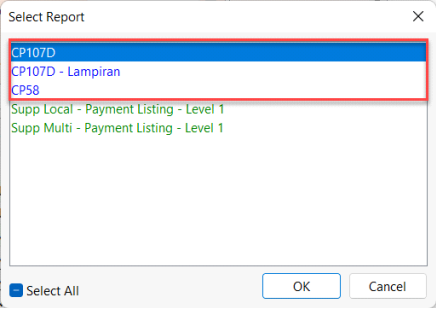

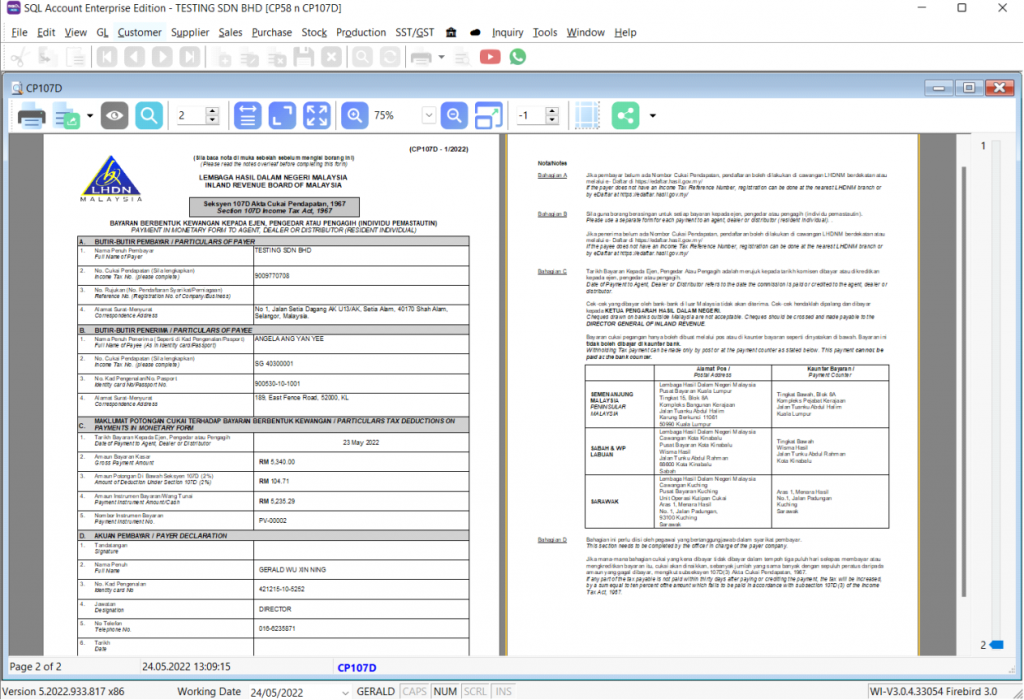

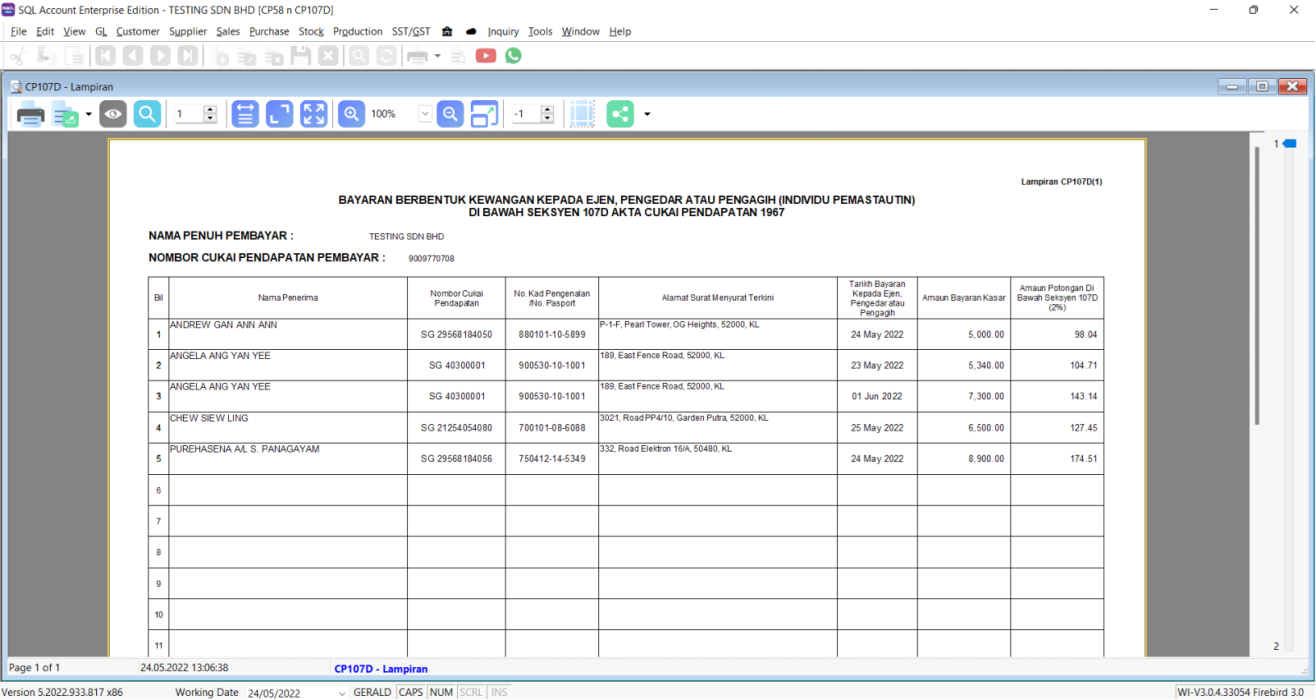

Preview and choose CP107D / Lampiran CP107D / CP58

Form CP107D

Lampiran CP107D

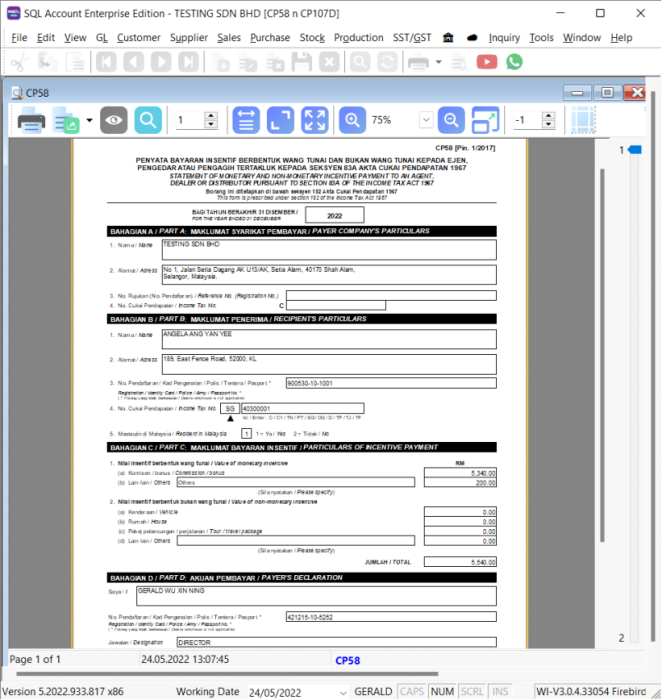

CP58

Related Video

SQL Accounting Software Favoured Features

SQL Account is an accounting software that is suitable for all businesses, from small businesses to large organizations. It is crucial to find a business solution that suits you. We cater for every industry. Small business, cloud accounting software, to on-premise accounting software, choose the best fit for your business. SQL Account is user friendly & can be integrated with no fuss.

Free Download Accounting Software trial to experience our accounting software.

Access Anytime, Anywhere

Batch Emails Statements

Special Industries Version

Real-Time CTOS Company Overview Reports

Advance Security Locks

Intelligence Reporting

SQL Account Features

General Ledger

It’s easy to manage and track your company’s accounting records

Customer

Keep your customers in touch

Supplier

Manage and keep your supply chain in check

Sales

More time. For Sales.

Purchase

Be cost effective.

Stock

Helps take control of your inventory effortlessly