What Is Wages Subsidy Programme (WSP)?

The purpose of the wage subsidy programme is to help employers affected economically by Covid-19 to continue operations and avoid the loss of jobs and income streams for all enterprises.

what is Wage Subsidy Programme (wSP)?

In efforts to ease the financial burdens of SMEs, and to assure that two-thirds of the work force will remain employed, Prime Minister Tan Sri Muhyiddin Yassin has announced a Wage Subsidy Programme (WSP).

Starting from April 9 2020, employers of Small and medium Enterprises(SMEs) can submit their applications for the wage subsidy scheme that was launched by Perkeso (SOCSO).

- Applications for the Wage Subsidy Programme (WSP) can be made online at prihatin.perkeso.gov.my.

- The dateline for application submission is on September 15 2020.

- Employers will get a 3 month period subsidy from the Wage Subsidy Programme (WSP)

- But what are the requirements for qualifying for the Wages Subsidy Programme (WSP) and how much financial assistance would you receive ?

- Employer must experience a decrease in earnings of more than 50% in comparison to the earnings made in January – February 2020. (Applicable for company size 76 employees & above), for company size with below 75 employee no condition on the decrease of salse)

- Subsidy is limited to 200 employees with salaries below RM 4000. Employees must also be registered under Employment Insurance System (EIS) / Sistem Insurans Pekerjaan (SIP).

- Employers are not allowed to deduct salaries of their existing staff

- Employers must not terminate or force their employees to take unpaid leaves for a minimum of 6 months, which includes 3 months during the subsidy period and 3 months post-subsidy.

- Company needs to be registered with PERKESO or EIS.

- Company must be registered with SSM before 1 January 2020.

- Commencement of Business must be before 1 January 2020.

- Employers and employees must be registered or contributed to SOCSO before 1 April, 2020

- Payment will be directly credited into the employers account within 7 to 14 days after the application date

Financial Assistance Rate

| Financial Assistance | Company Size | Employee Limit |

|---|---|---|

| RM 1200 monthly per employee | 75 employees and above | 75 employees |

| RM 800 monthly per employee | 76 - 200 employees | 200 employees |

| RM 600 monthly per employee | 201 employees and above | 200 employees |

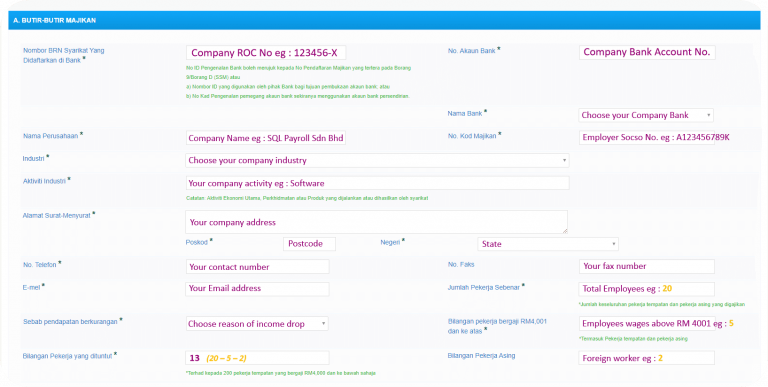

Step To Claim Wage Subsidy Programme (WSP)

Click on PERMOHONAN & SEMAKAN button in Prihatin PKS+

Click on PERMOHONAN BULAN PERTAMA button

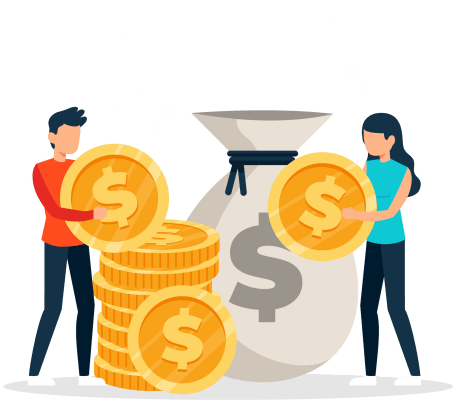

- A) PSU Declaration

Click here to download the format & fill in manually or, generate it from SQL Payroll directly.

Print directly from SQL Payroll, sign & upload.

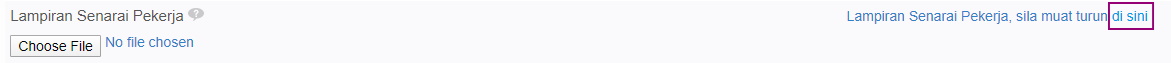

- B) Attachment of Employee List

Click here to download the format & fill in manually.

Sample of Employee List

Column Explanation

| No Tuntutan Ke (1,2,3) | 1 = 1st Time Apply, 2 = 2nd Time Apply |

| Name Pekerja | Employee Name |

| No. Kad Pengenalan | Identification Number (I.C No) |

| Jantina | Gender |

| Pangkat | Rank/ Level |

| Jawatan) | Position |

| Pendidikan | Education |

| No. Telefon | Contact Number |

| Email Pekerja | Employee email address |

| Gaji Semasa (RM) | Current Salary (Include OT, Commission, Bonus, Gross Salary) |

- C) Copy of SSM / ROS / ROB

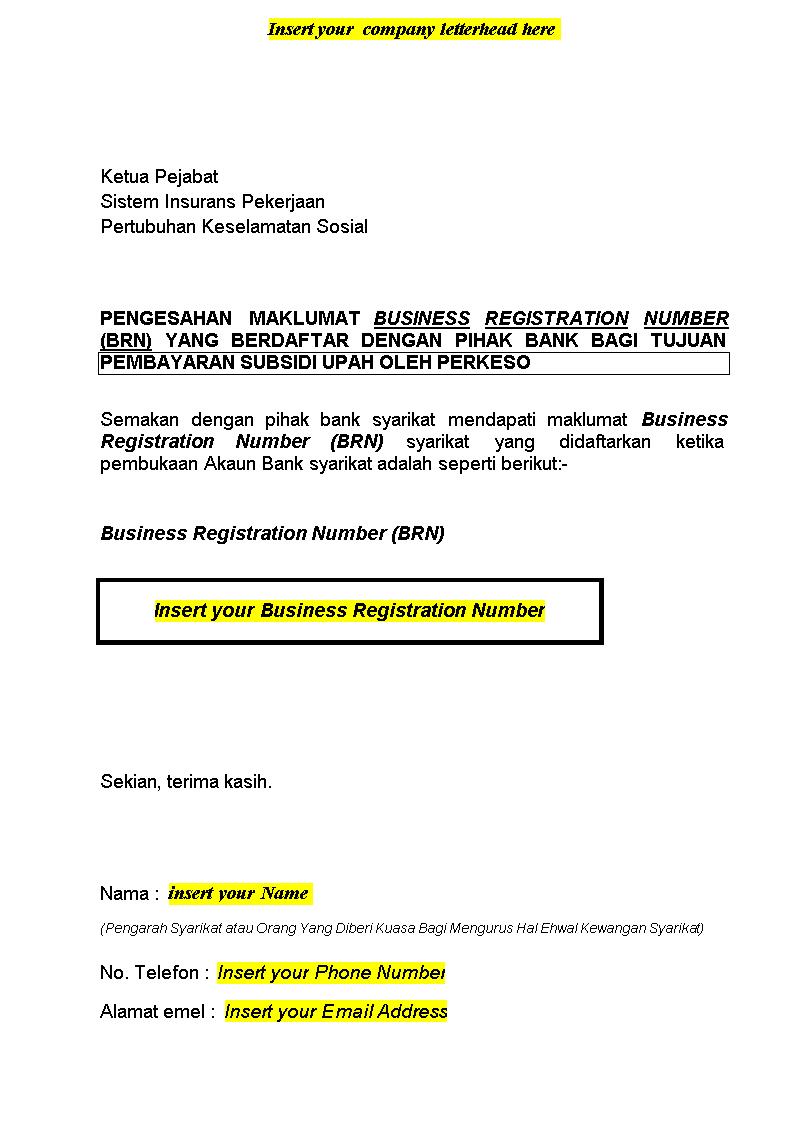

- d) Bank ID/ MyCOID identification No.

Click here to download the file. Then fill in your company letterhead, business registration number, your name , your phone number, your email address.

Sample of Bank ID/ MyCOID form

- e) Copy of Financial Statement / Sales Report

FAQ regarding wage Subsidy Programme

- What should I do if my company's application for Wages Subsidy Programme (WSP) is approved?

Employers can claim the subsidy from SOCSO given that they have paid their employees their full salary. Employers must still contribute monthly for their employees’ SOCSO and EIS payments based in the employee’s actual salary amount

- Can I apply for both the Employment Retention Programme (ERP) and the wage subsidy programme (WSP) at the same time?

Employers whose application for ERP has been approved can also apply for the wage subsidy programme if their companies meet the wage subsidy guidelines.

But employers cannot apply for ERP and wage subsidy for the same employee for the same month.

- Do I still need to pay my employees their full salary if my application for Wage Subsidy Programme (WSP) has been approved?

Yes, employers still need to pay their employees full salary.

- If there was an agreement between the employees and the employer to take Unpaid Leave or to have a salary deduction in order to keep the business running, does the company still qualify for Wages Subsidy Programme (WSP)?

No. This is not allowed based on the eligibility requirement given for Wage Subsidy Programme (WSP).

SQL Accounting Software Favoured Features

Access Anytime, Anywhere

Batch Emails Statements

Special Industries Version

Real-Time CTOS Company Overview Reports

Advance Security Locks

Intelligence Reporting

SQL Payroll software Favoured Features

Certified by Statutory bodies & 100% accurate

electronic submission & e-Payment ready

Batch email payslip

Comprehensive management reports

Unlimited year records