Steps to Submit & Pay Personal Income Tax

Learn how to submit your personal income tax in Malaysia. Get step-by-step guidance from register tax account, submitting income tax online, and making tax payments online. Employees will receive EA form latest by end of February every year, and tax submissions are required to be done by before end of April every year. Don’t miss out on tax rebates and relief – follow our comprehensive guide now!

How to Submit Personal income Tax on MyTax Portal?

- Go to LHDN MyTax Portal, select Identification Card No. and insert your IC number. Click on “Submit” button to log in to your account (For 1st time tax payer, please refer ‘How To Register Income Tax Account For The 1st Time?‘)

-

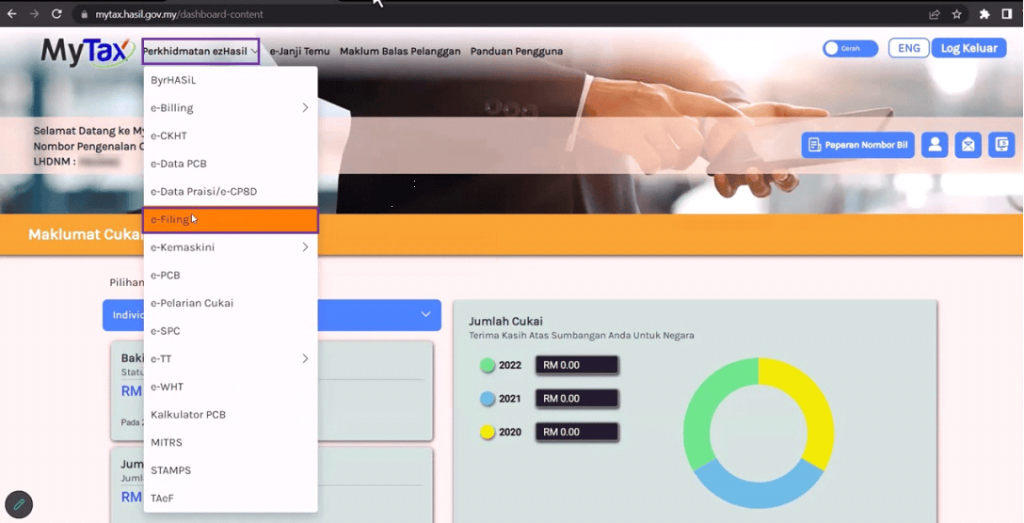

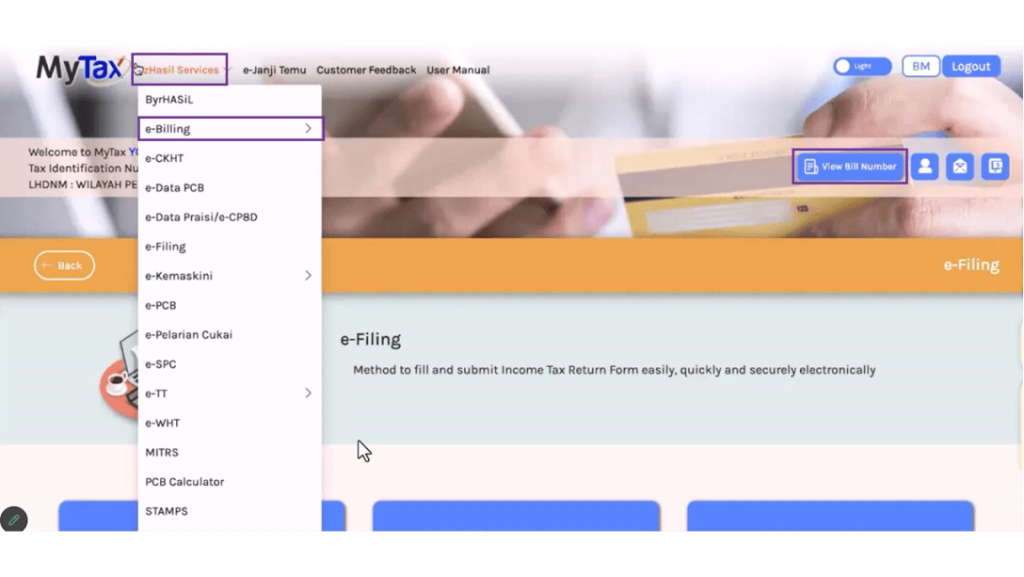

On the top part of the MyTax portal page, select “Perkhidmatan ezHasil (ezHasil Services)” and then click on “e-Filing”

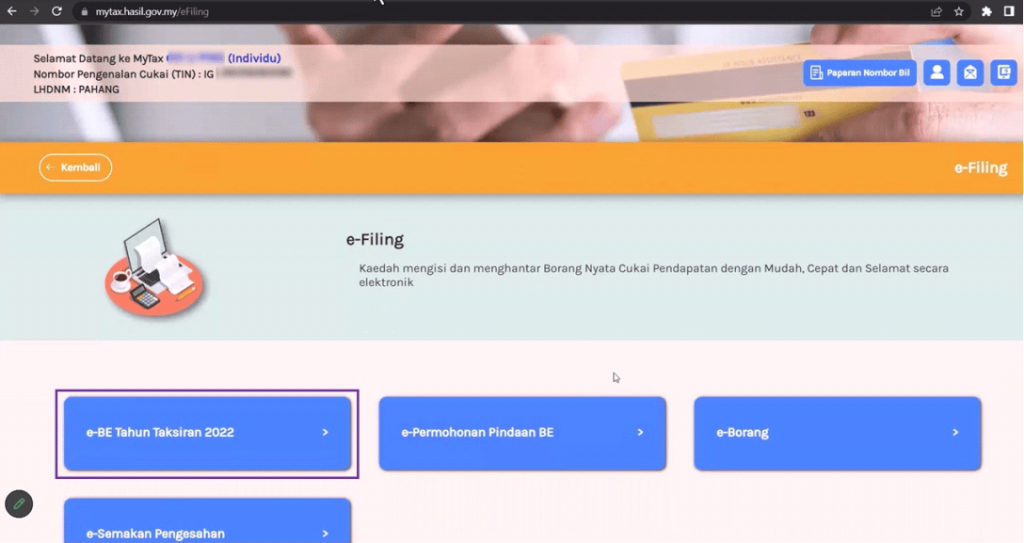

- Select “e-BE Tahun Taksiran 2022 (e-BE Year of Assessment 2022)” to file your personal income tax return for the current assessment year

-

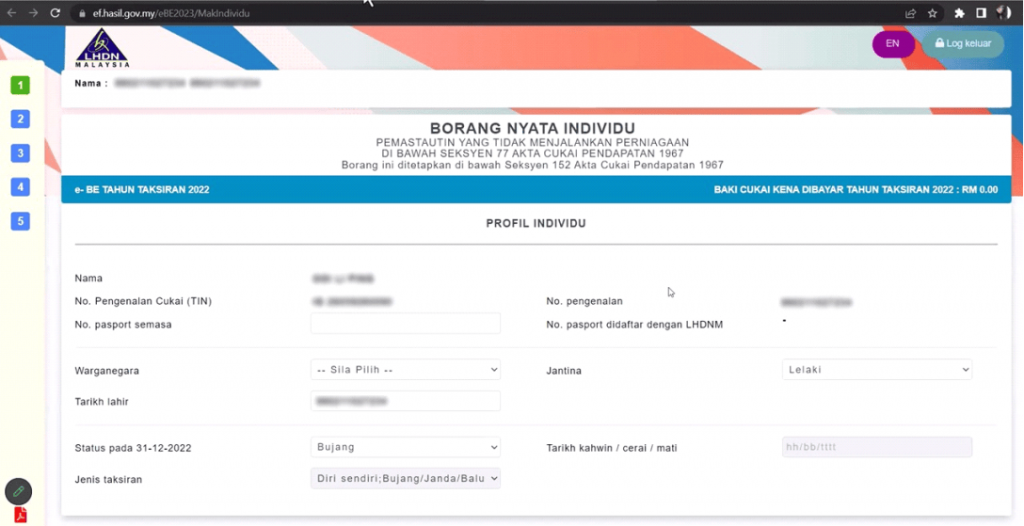

Check all the individual information that has been pre-filled by the system, such as your name, IC number, and tax number, make sure all the information is accurate

-

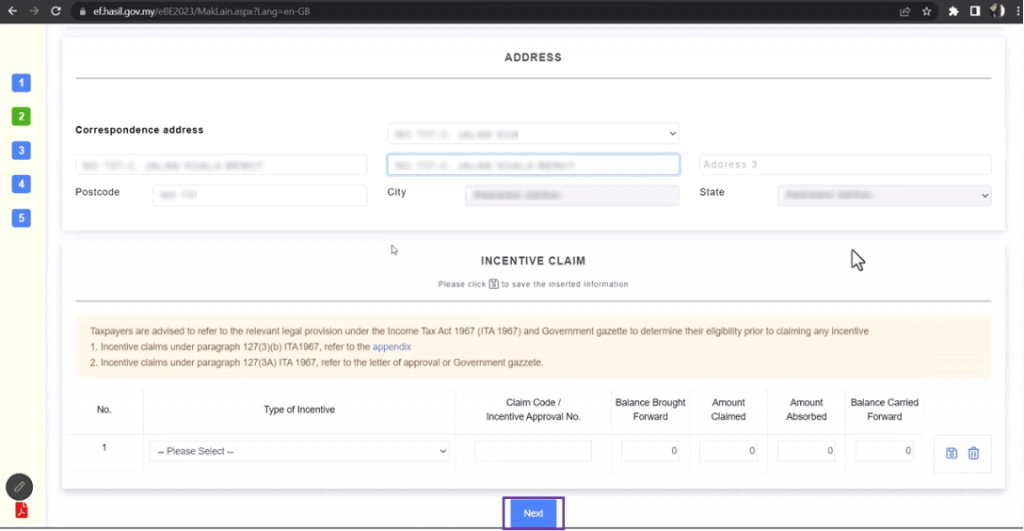

Fill up your address, click on the “Next” button to proceed to the next section

-

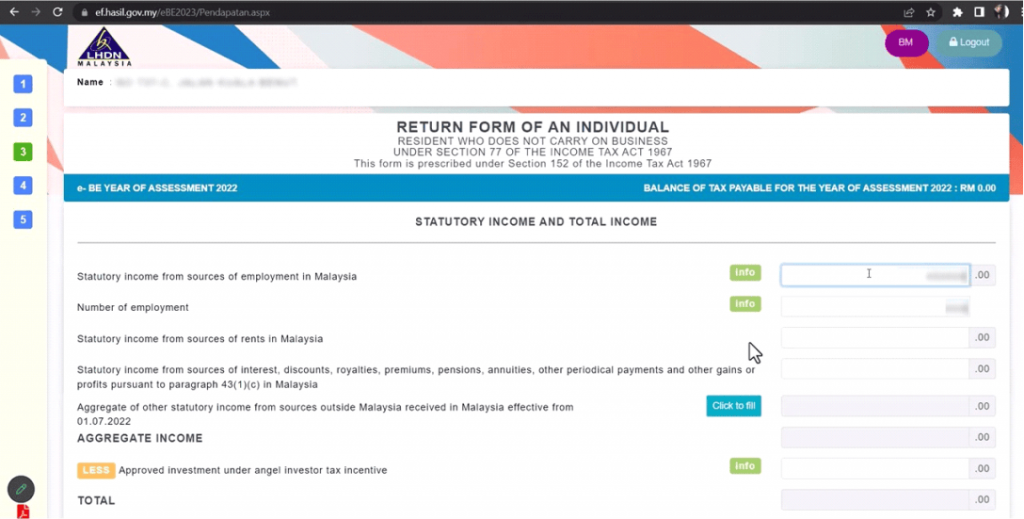

Enter your statutory income and any other income that you may have earned throughout the year. This includes income from employment, rental income, and any other income that you have received

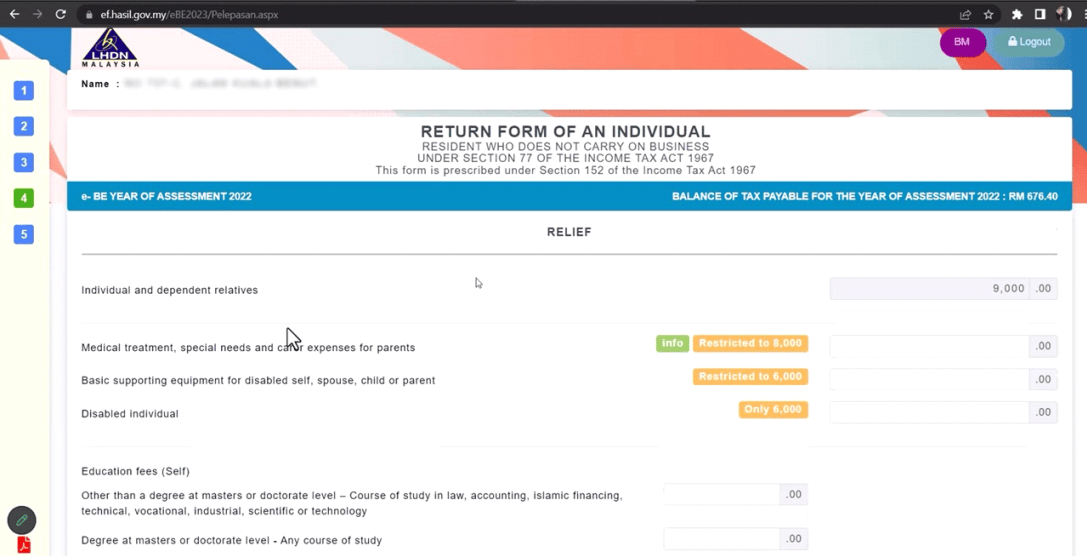

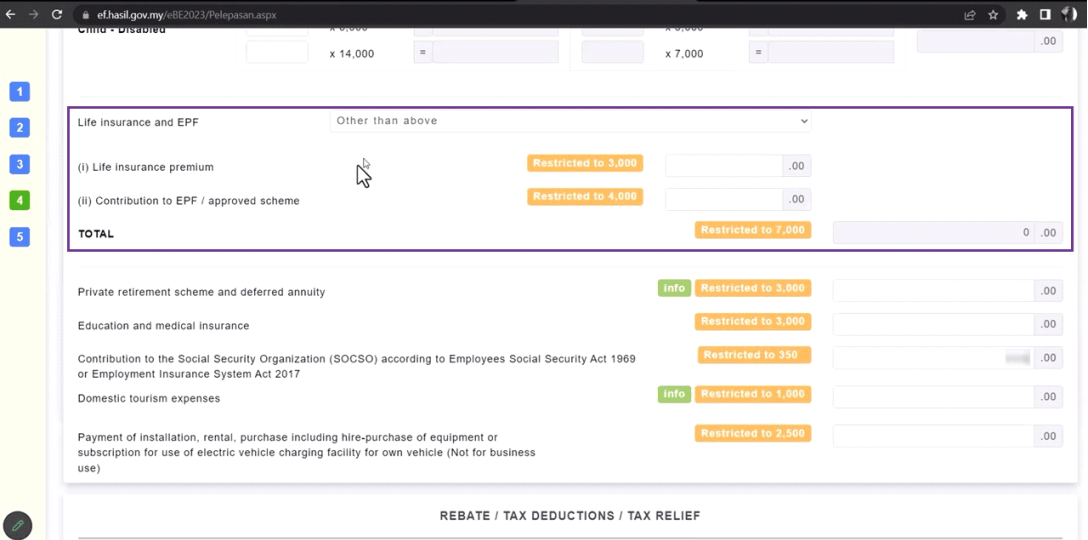

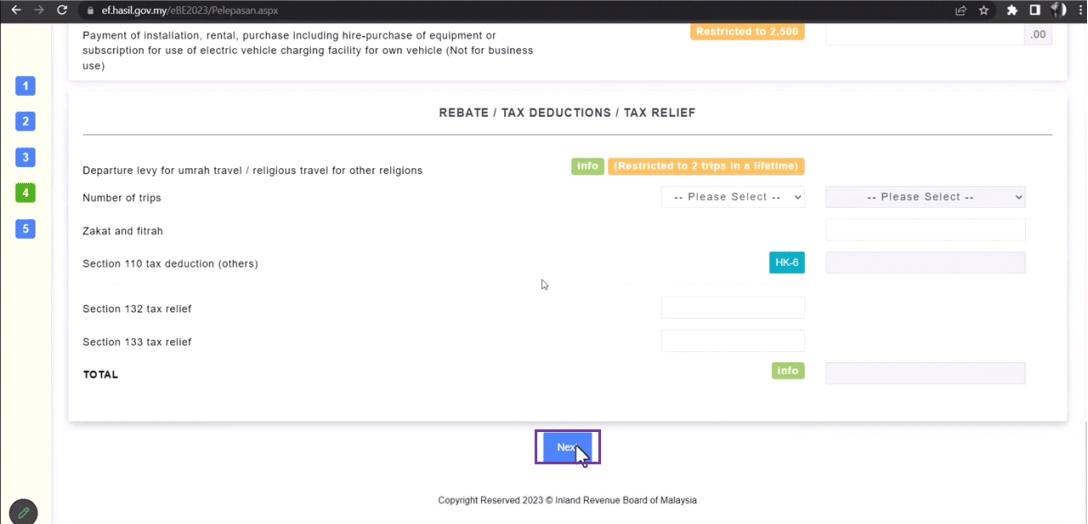

- Fill Up Tax Relief Section

- In this section, you will be able to claim tax reliefs to reduce your taxable income and get the maximum tax rebate

- If you have made any purchases such as a personal computer or smartphone, don’t forget to include them under lifestyle relief, it can get additional tax savings

- Filling up all the other tax reliefs that you are eligible for, such as life insurance relief, EPF relief, and others

- Once you have filled up all the tax relief, click on “Next” to proceed to the next step

- In this section, you will be able to claim tax reliefs to reduce your taxable income and get the maximum tax rebate

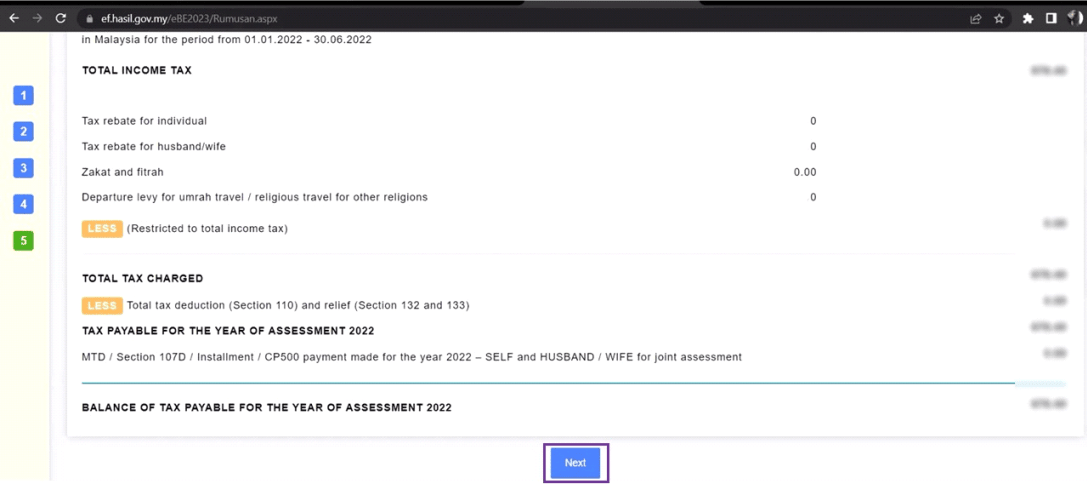

- Verify & Submit

- Check the summary of all the information you have entered, including your income, tax relief, and rebate. It is important to double-check all the details to ensure their accuracy. Once you have verified everything, click on “Next” to proceed to the next step

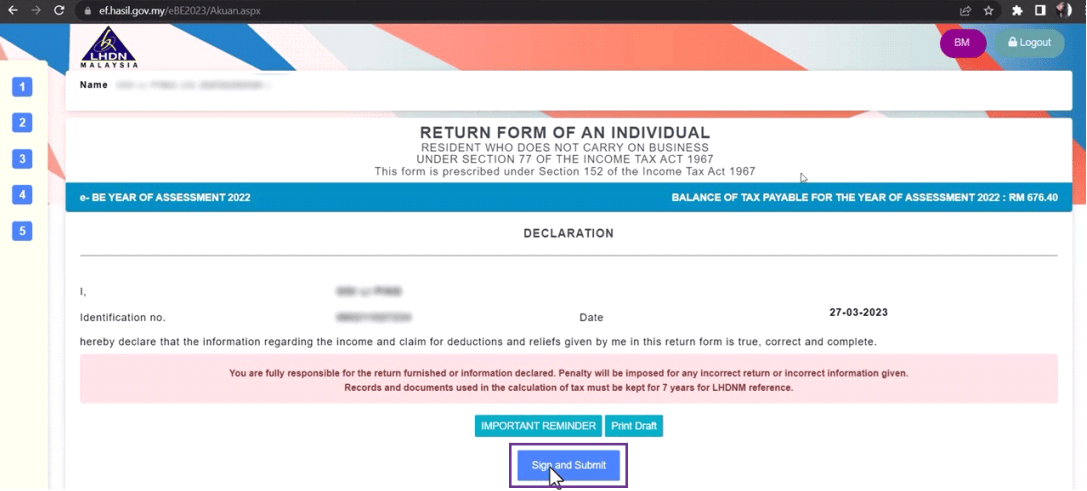

- After you have reviewed and confirmed that all the information is accurate, you can proceed to sign and submit your tax return. Click on the “Sign & Submit” button to complete the submission process

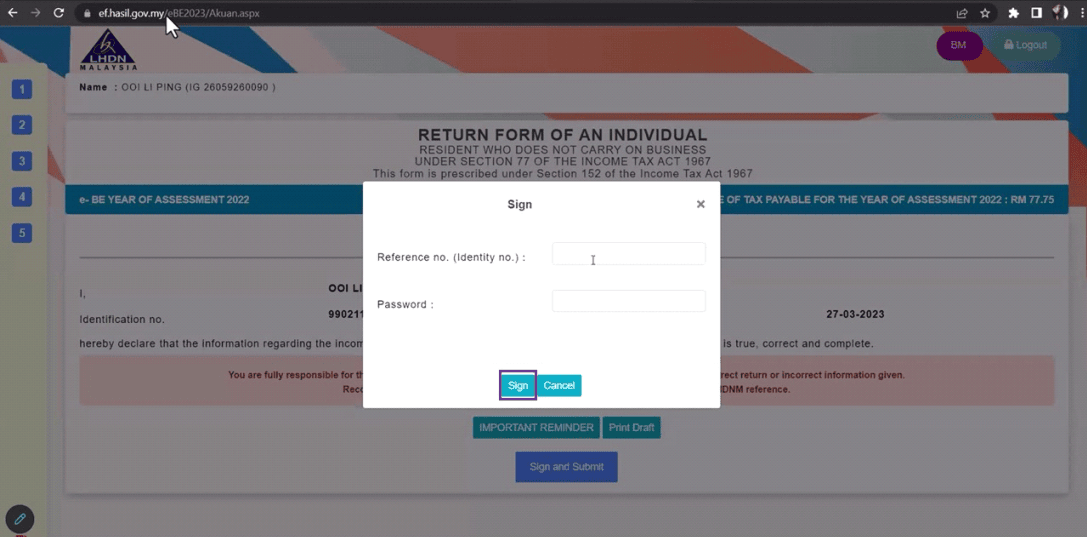

- Enter your identification number and password to sign the tax return

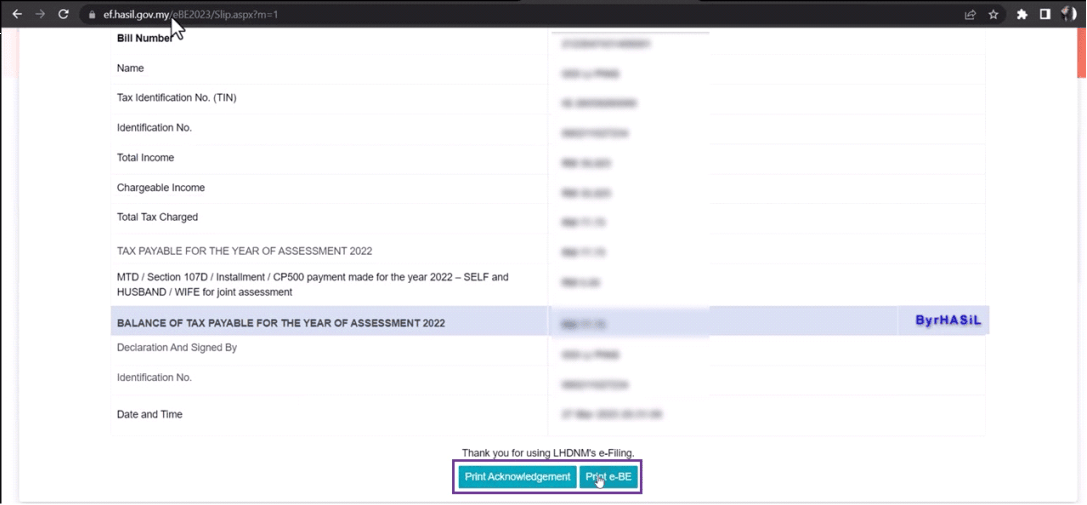

- After successfully submitted your tax return, it is recommended that you print both the acknowledgement and e-BE for your records. This will serve as proof of submission and can be used for reference purposes in the future

- If you are entitled to a tax rebate, you do not need to make any payment as the rebate will be credited to the bank account you provided in your individual account information. However, if you need to pay additional tax, please follow the next guide to make your payment

- Check the summary of all the information you have entered, including your income, tax relief, and rebate. It is important to double-check all the details to ensure their accuracy. Once you have verified everything, click on “Next” to proceed to the next step

How to Make Payment for Personal income Tax on MyTax Portal?

- Once you have completed your tax filing and if you need to make tax payments, you can proceed to “Perkhidmatan ezHasil (ezHasil Services)” and click on “e-Billing” of click the button “view bill number” on the right side

-

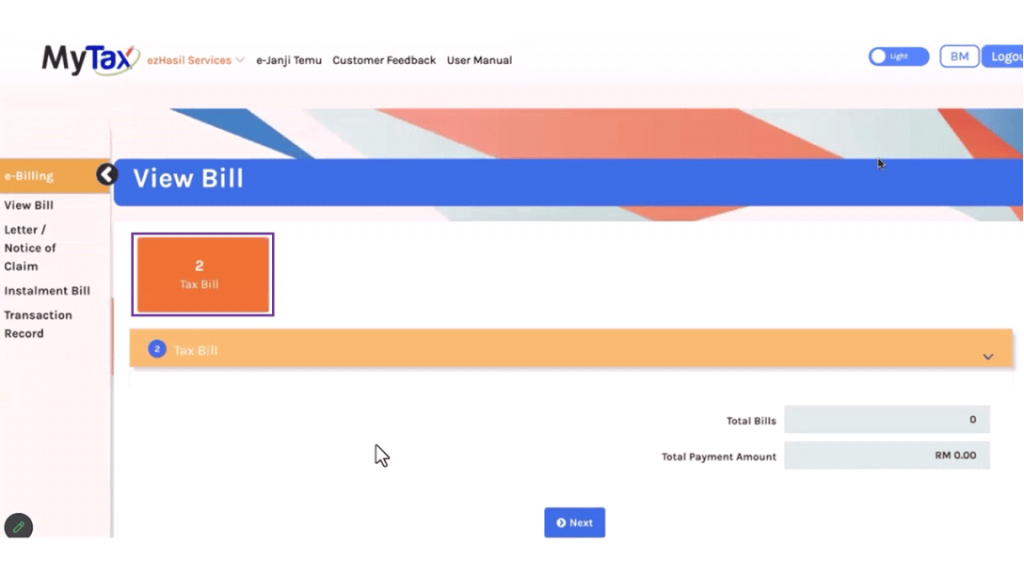

If you have a tax bill that needs to be paid, you will see a “number” of Tax Bill. Click on the number and proceed to the next step

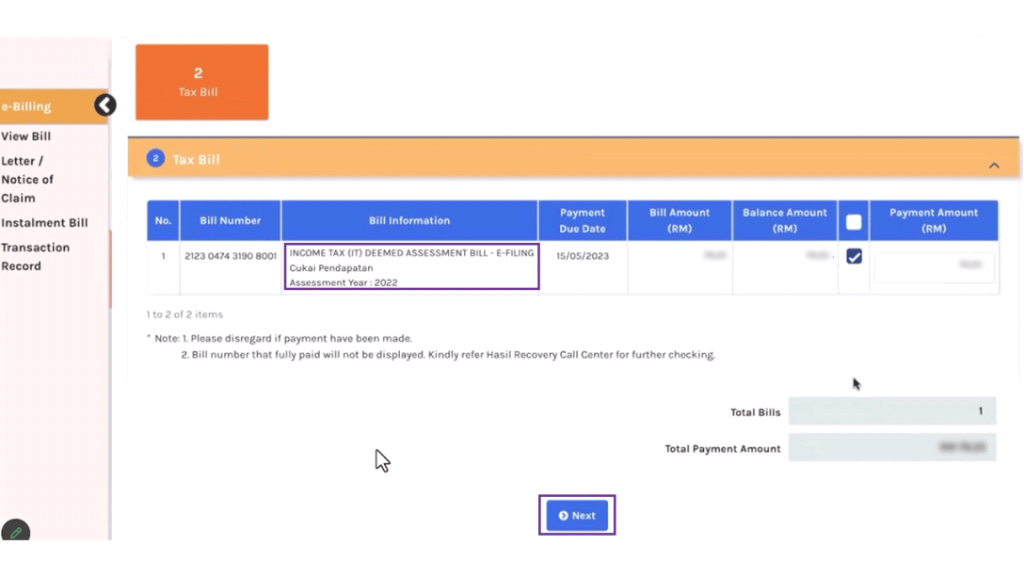

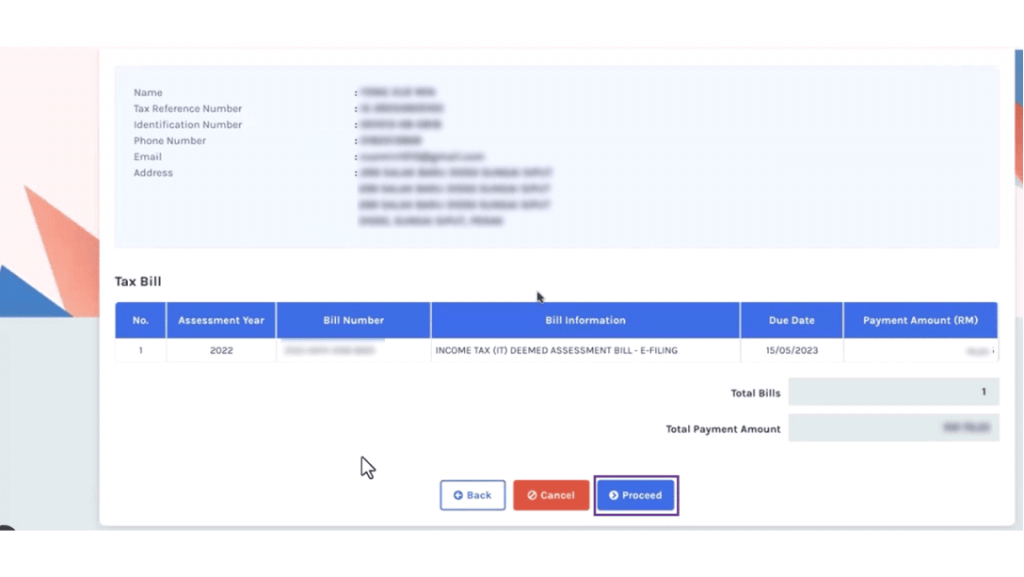

- Check the bill information and then click on the “Next” button to proceed with the payment

-

Once you have confirmed that all the details are correct, you can click on the “Proceed” button to proceed with payment

-

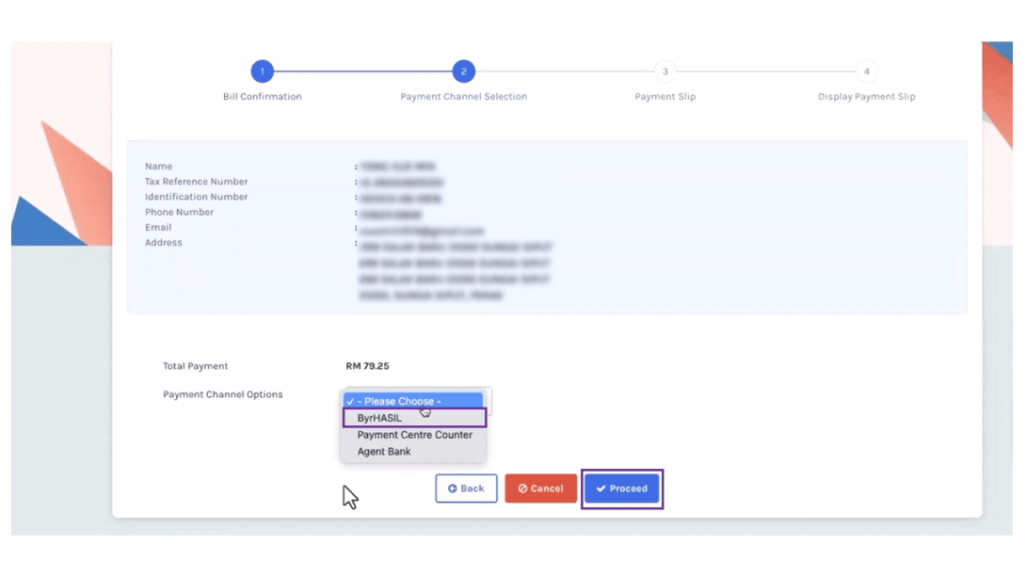

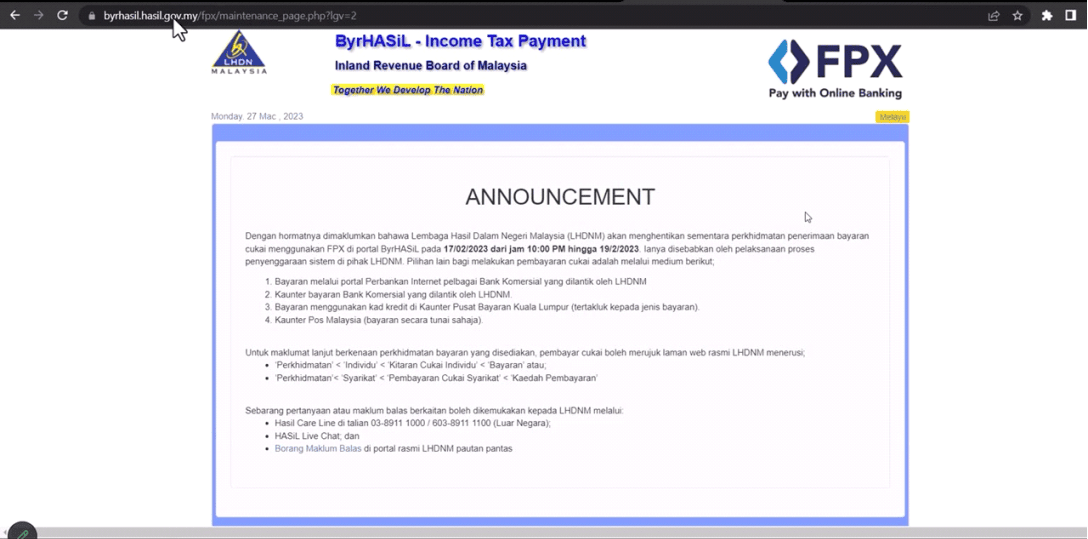

Choose the payment channel option and select the “ByrHASIL” option for FPX online payment

-

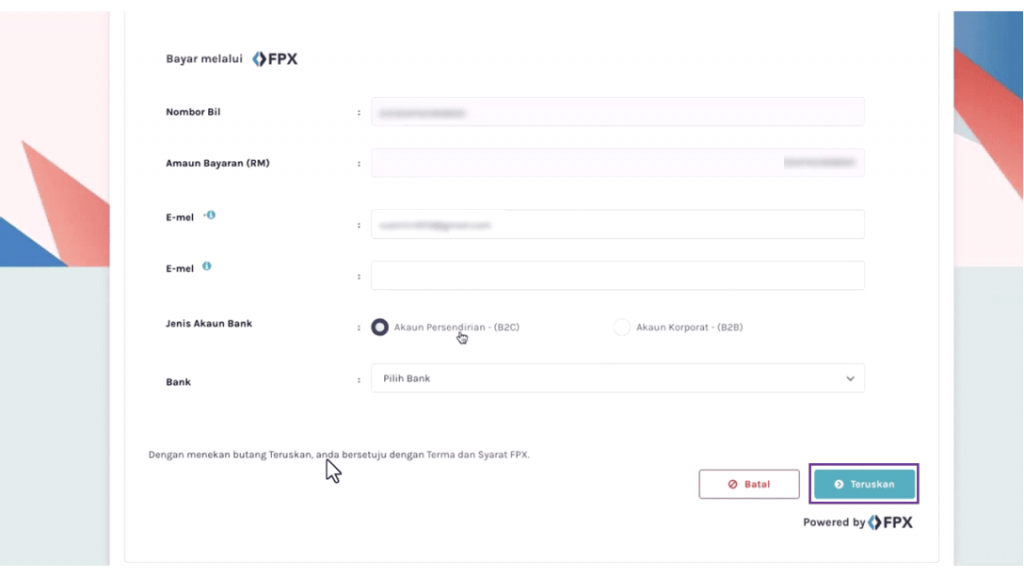

Review all the payment details carefully, select your bank, and then click on “Teruskan (next)” to proceed with the FPX payment

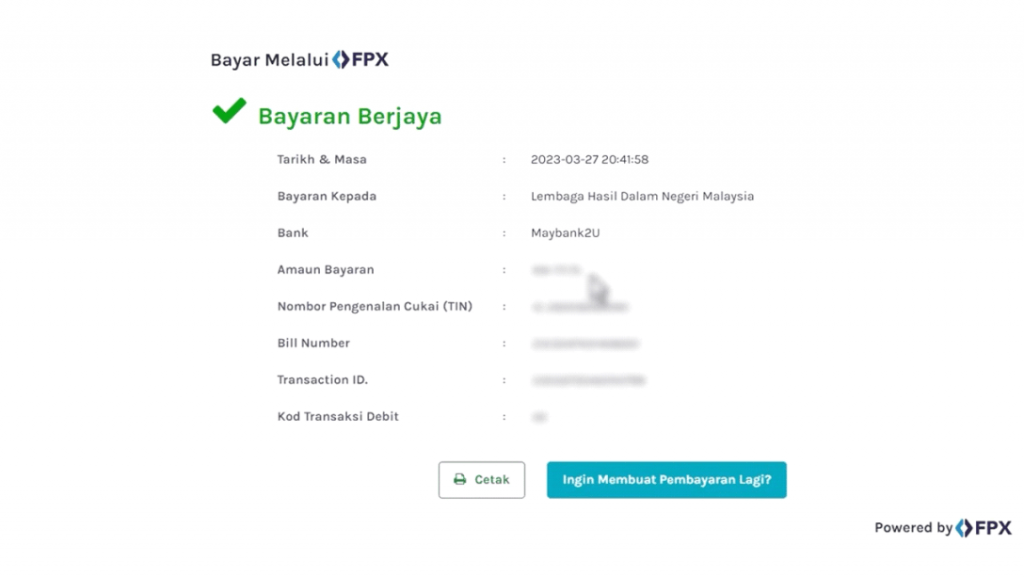

- After completing the payment process, make sure to print out the payment slip as proof of payment for your records. It is recommended to keep this slip safe and easily accessible in case it is needed in the future

Share This Page

Share

Tweet

Related Posts

SQL Payroll software Favoured Features

Certified by Statutory bodies & 100% accurate

Compliant with employment requirements in Malaysia. Inclusive of KWSP, SOCSO, LHDN, EIS, HRDF, EPF Borang A, SOCSO Borang 8A, Income Tax CP39, and Borang E ready. SQL Payroll software is ready to use with minimal setup for all companies.

electronic submission & e-Payment ready

SQL Payroll Software E-submission format are prepared for all banks in Malaysia. Maybank, CIMB, HLBB, Public Bank & many more

Batch email payslip

Securely send payslips to employees using batch email with password encryption

Comprehensive management reports

Print payroll summary, yearly payroll individual report, contribution info report & many more.

Unlimited year records

Records salary info for unlimited amount of years & print EA forms for any year

E Leave mobile app

Apply for leave anytime anywhere with speedy approval from management. Get managerial view of individual leave reports and EA forms