SOCSO & EIS Combine Submission

Starting from July 2022, employers can now combine to submit SOCSO and EIS contributions simultaneously in the PERKESO portal under “Combine Contribution”. Employers can make submission by manual enter data or uploading a contribution text file.

How do i submit my SOCSO + EIS Combine Contribution?

- Login into PERKESO Portal

- Go to My Sites > Contributions > SOCSO + EIS

- Select Employer Code

- Upload the text file that you have generated from SQL Payroll (refer Method 1) or select the month of the contribution (refer Method 2)

Notes:Employer Contribution Pending List

- A list of outstanding contribution submission for SOCSO + EIS combine contribution

- Click on “Action” icon will redirect to Combine Contribution data entry screen

unsubmitted contribution (Draft)- A list of draft SOCSO + EIS combine contribution submission

- Click on “Edit” icon to edit and submit combine contribution

- Click on “Remove” icon to delete the draft

- Tick the checkbox of the drafts and click on “Remove Draft(s)” to delete multiple drafts

“Text File” Button – Method 1- Click this button for submission using SOCSO + EIS combine contribution text file

“Arrears Contribution” Button – Method 2- Click this button for submission of back dated or previous contribution month

Method 1: Upload combine contribution text file

- Generate the EIS & SOCSO contribution text file from SQL Payroll

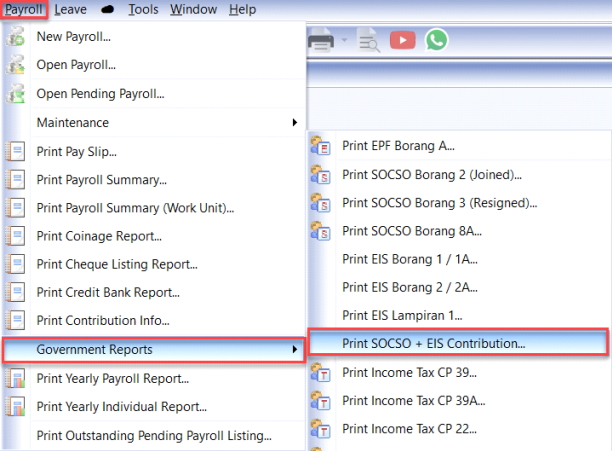

- In SQL Payroll, go to Payroll > Government Reports > Print SOCSO + EIS Contribution

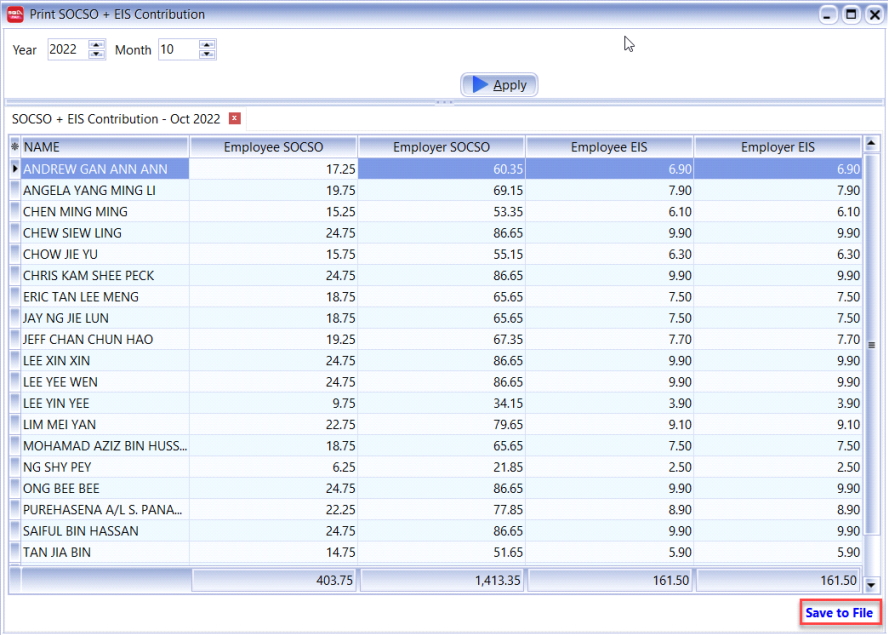

- Select the month, click on Apply > Save to Text. All SOCSO & EIS calculated automatically with few simple clicks

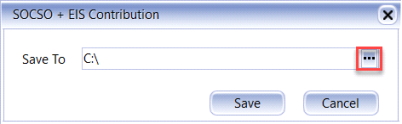

- Click on the … button

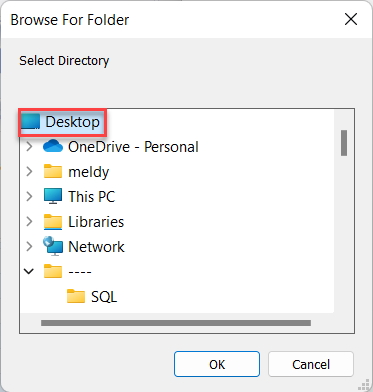

- Save on Desktop and press OK. A text file is generated on your desktop

- Upload generated text file

- In PERKESO Portal, click “Choose File” button and choose the generated text file

- Click “Upload” button

- Double check calculated contribution amount

Click “Action” icon to see the detailed breakdown of the calculated combine contribution amount

Method 2: Manual data entry for SOCSO + EIS

- Read information of contribution submission

“Contribution Month” and “Act” will be displayed based on user’s previous selection

- Enter employees’ contribution

For 1st time submission, enter employee’s wages / salary or for editing, click the “Action” icon

Notes:

- Search for specific employee’s contribution by entering Employee Identification Number

- Employee contribution details for SOCSO + EIS combine contribution will be listed in sequence based on previous Combine Contribution submission

- Summary of Combine Contribution submission will be displayed on the bottom section after update

- Click “Save Draft” button if you want to revisit the draft of Contribution Submission later

- Click “Submit” then the “Acknowledgement Contribution Received (ACR)” and “EIS Contribution Received (ECR)” document will be generated

Notes:

- Click “Print ACR/ECR” button to download the PDF file or to print the document

- Press “FPX Payment” to proceed with the payment and complete the process

Video Tutorial (Method 1)

How to make EIS payment online?

Login into your PERKESO Portal make payments for SOCSO and EIS contributions using Financial Processing Exchange (FPX) payment.

- Go to My Sites > Payment > FPX > Payment

Notes:

- System will display both ACR and ECR summary for combine contribution submission

- Click “View” icon to see the details of the ACR and ECR

- Click “Remove” icon to delete any unnecessary ACR and ECR

- Tick the checkboxes to select the transaction that you want and click “Add to Cart” to proceed

- Click “Proceed to Summary” button to proceed with FPX payment

- In the payment cart, double check the details. After confirming the details press “Continue” and you will be redirected to the FPX payment screen

Notes:

- Press “Search Payment” to check for any outstanding payment

- Press “Clear List” to remove all selected transactions in the payment cart

- Key in FPX payment information

- Select Business Model, key in your bank account number and email address

- Click “Proceed” and you will be redirected to your bank’s online banking website

Notes:Types of Business Models:- Corporate to Corporate (B2B): payment made using company’s bank account

- Personal to Corporate (B2C): payment made using an individual / personal bank account

- Check payment status

Click “Action” icon to view payment details and receiptNotes:

- If payment is completed, you will see status “Success”. But if payment has failed, a status “Failed” will be shown

Video Tutorial

SQL Payroll software Favoured Features

Certified by Statutory bodies & 100% accurate

Compliant with employment requirements in Malaysia. Inclusive of KWSP, SOCSO, LHDN, EIS, HRDF, EPF Borang A, SOCSO Borang 8A, Income Tax CP39, and Borang E ready. SQL Payroll software is ready to use with minimal setup for all companies.

electronic submission & e-Payment ready

SQL Payroll Software E-submission format are prepared for all banks in Malaysia. Maybank, CIMB, HLBB, Public Bank & many more

Batch email payslip

Securely send payslips to employees using batch email with password encryption

Comprehensive management reports

Print payroll summary, yearly payroll individual report, contribution info report & many more.

Unlimited year records

Records salary info for unlimited amount of years & print EA forms for any year

E Leave mobile app

Apply for leave anytime anywhere with speedy approval from management. Get managerial view of individual leave reports and EA forms