What is EA Form / Borang EA?

EA form is a Yearly Remuneration Statement for private employees that includes your salary for the past year. EA form is used for the filing of personal taxes during tax season.

Why We Need EA Form?

We need EA forms to ensure that we are declaring the right amount of earnings and exemptions in our filing.

The EA Form also can be used to check if we are above the pay grade that requires us to pay taxes.

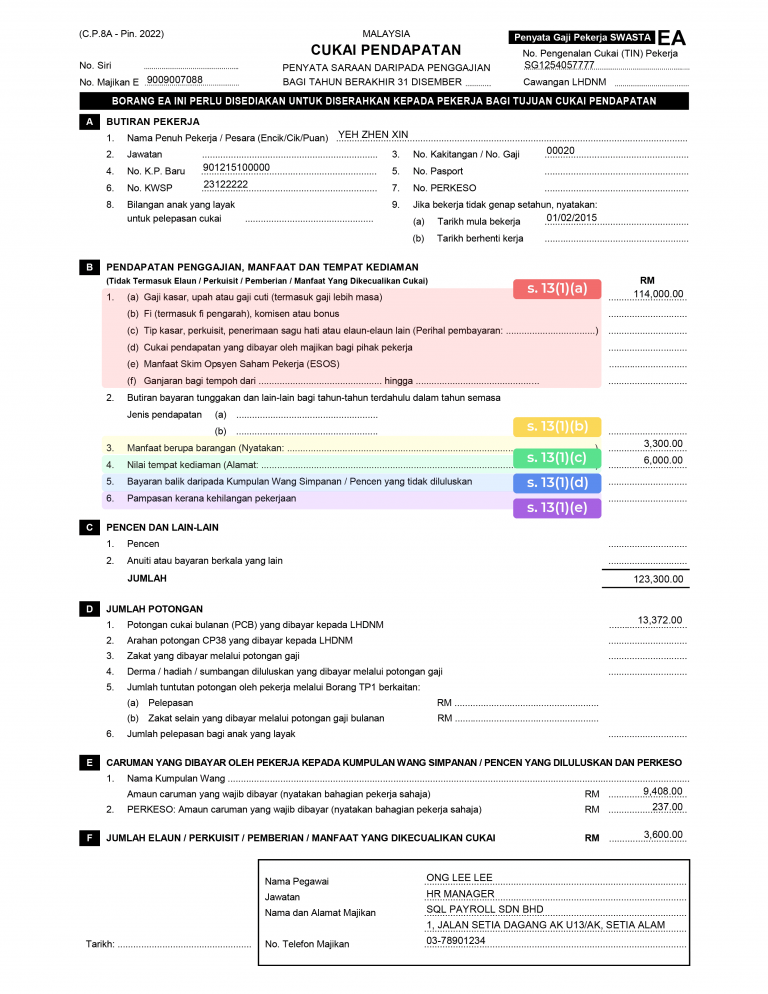

Example of EA Form

Employers have to prepare and distribute the EA Form before the last day of February every year.

Failure to prepare and render EA Form to employees before last day of February,

fine of RM 200 to RM 20,000 or imprisonment for a term not exceeding 6 months or both.

- s.13(1)(a): Wages, salary, remuneration, leave pay, fee, commission, bonus, gratuity, perquisite or allowance

- s.13(1)(b): Benefit in kind (“BIK”) – leave passage, driver, motor vehicle etc

- s.13(1)(c): Value of living accommodation (“VOLA”)

- s.13(1)(d): Amount from unapproved pension or provident fund

- s.13(1)(e): Compensation for loss of employment

- To assist taxpayers who have lost their jobs due to the pandemic, for years of assessment in 2020 and 2021, the income tax exemption limit for compensation for loss of employment will be increased from RM10,000 to RM20,000 for each full year of service

Employer Tax Obligation

What if there’s a new employee in my company?

- Employer’s must notify the nearest assessment branch within the first month starting from the date of the new employee’s commencement of employment by using Form CP22.

- Failure to do so will result in a fine ranging from RM200 to Rm2000, or imprisonment for a term not exceeding six months.

What if my employee retires or has been ceased from employment?

- It is the employer’s responsibility to inform IRBM at least 30 days before the employee’s cease date IF:

-

- The employee is about to retire.

- The employee is about to leave Malaysia permanently

- The employee is subjected to MTD scheme and employer has not made any deductions.

- The forms used would be CP22A – Notification of cessation of employment

- Failure to do so will result in a fine ranging from RM200 to Rm2000, or imprisonment for a term not exceeding six months.

Borang B / BE Tax Calculator

Hot Topic

Accountant, when come to Borang B & Borang B submission, a common question may ask from your customers:

I just want tax payable RM 8000 only, how much yearly income do I need to report to LHDN? What us my tax bracket %?

This professional tax calculator can help you, lets click on the calculate button to try it now for FREE!

Tutorial Videos

Videos

SQL Payroll EA Form

SQL Professional Tax Planner

Share This Page

Share

Tweet

SQL Payroll software Malaysia Favoured Features

Certified by Statutory bodies & 100% accurate

Compliant with employment requirements in Malaysia. Inclusive of KWSP, SOCSO, LHDN, EIS, HRDF, EPF Borang A, SOCSO Borang 8A, Income Tax CP39, and Borang E ready. SQL Payroll software is ready to use with minimal setup for all companies.

electronic submission & e-Payment ready

SQL Payroll Software E-submission format are prepared for all banks in Malaysia. Maybank, CIMB, HLBB, Public Bank & many more

Batch email payslip

Securely send payslips to employees using batch email with password encryption

Comprehensive management reports

Print payroll summary, yearly payroll individual report, contribution info report & many more.

Unlimited year records

Records salary info for unlimited amount of years & print EA forms for any year

E Leave mobile app

Apply for leave anytime anywhere with speedy approval from management. Get managerial view of individual leave reports and EA forms